MP Materials Corp. (MP): Price and Financial Metrics

MP Price/Volume Stats

| Current price | $16.55 | 52-week high | $36.67 |

| Prev. close | $16.52 | 52-week low | $14.47 |

| Day low | $16.26 | Volume | 1,658,000 |

| Day high | $16.69 | Avg. volume | 2,473,667 |

| 50-day MA | $17.31 | Dividend yield | N/A |

| 200-day MA | $19.63 | Market Cap | 2.94B |

MP Stock Price Chart Interactive Chart >

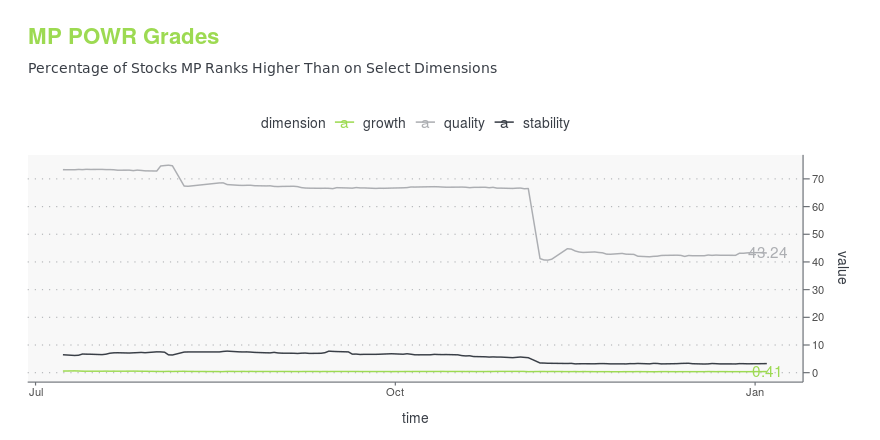

MP POWR Grades

- MP scores best on the Quality dimension, with a Quality rank ahead of 43.24% of US stocks.

- The strongest trend for MP is in Stability, which has been heading down over the past 26 weeks.

- MP's current lowest rank is in the Growth metric (where it is better than 0.41% of US stocks).

MP Stock Summary

- Price to trailing twelve month operating cash flow for MP is currently 31.6, higher than 87.21% of US stocks with positive operating cash flow.

- With a price/sales ratio of 10.92, MP MATERIALS CORP has a higher such ratio than 90.18% of stocks in our set.

- Revenue growth over the past 12 months for MP MATERIALS CORP comes in at -42.73%, a number that bests merely 5.98% of the US stocks we're tracking.

- Stocks with similar financial metrics, market capitalization, and price volatility to MP MATERIALS CORP are METC, EVTC, CLVT, EGLE, and NRP.

- To dig deeper into the stock's financial statements, go to MP's page on browse-edgar?action=getcompany&CIK=0001801368.

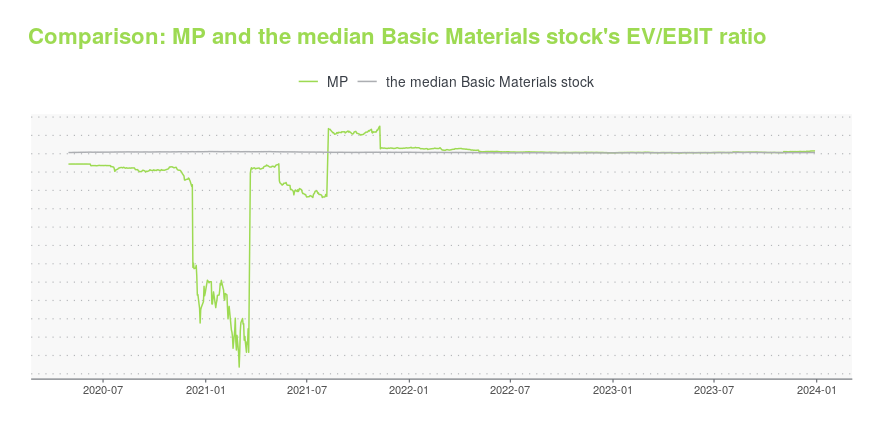

MP Valuation Summary

- In comparison to the median Basic Materials stock, MP's EV/EBIT ratio is 120.15% higher, now standing at 29.5.

- Over the past 45 months, MP's EV/EBIT ratio has gone up 142.4.

Below are key valuation metrics over time for MP.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| MP | 2023-12-29 | 11.6 | 2.6 | 32.8 | 29.5 |

| MP | 2023-12-28 | 11.9 | 2.6 | 33.8 | 30.5 |

| MP | 2023-12-27 | 12.0 | 2.7 | 34.0 | 30.7 |

| MP | 2023-12-26 | 12.0 | 2.7 | 34.1 | 30.8 |

| MP | 2023-12-22 | 11.7 | 2.6 | 33.2 | 29.9 |

| MP | 2023-12-21 | 11.6 | 2.6 | 33.0 | 29.6 |

MP's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- MP has a Quality Grade of C, ranking ahead of 65.51% of graded US stocks.

- MP's asset turnover comes in at 0.213 -- ranking 25th of 42 Non-Metallic and Industrial Metal Mining stocks.

- 500 - Internal server error

The table below shows MP's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.213 | 0.627 | 0.027 |

| 2021-03-31 | 0.219 | 0.579 | -0.020 |

| 2020-12-31 | 0.304 | 0.525 | -0.109 |

MP Price Target

For more insight on analysts targets of MP, see our MP price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $45.00 | Average Broker Recommendation | 1.5 (Moderate Buy) |

MP Materials Corp. (MP) Company Bio

MP Materials Corp. owns and operates integrated rare earth mining and processing facilities. It owns and operates the Mountain Pass facility located in the Western Hemisphere. The company holds the mineral rights to the Mountain Pass mine and surrounding areas, as well as intellectual property rights related to the processing and development of rare earth minerals. It offers neodymium and praseodymium that are rare earth elements, which in combination form neodymium-praseodymium. The company was founded in 2017 and is headquartered in Las Vegas, Nevada.

Latest MP News From Around the Web

Below are the latest news stories about MP MATERIALS CORP that investors may wish to consider to help them evaluate MP as an investment opportunity.

RIO or MP: Which Is the Better Value Stock Right Now?RIO vs. MP: Which Stock Is the Better Value Option? |

13 Most Promising EV Stocks According To Hedge FundsIn this piece, we will take a look at the 13 most promising EV stocks according to hedge funds. If you want to skip our overview of the electric vehicle industry, then you can take a look at the 5 Most Promising EV Stocks According To Hedge Funds. The 21st century has bred several new […] |

MP Materials (NYSE:MP) Is Looking To Continue Growing Its Returns On CapitalFinding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key... |

RIO vs. MP: Which Stock Is the Better Value Option?RIO vs. MP: Which Stock Is the Better Value Option? |

Billionaire Lee Cooperman’s 10 Stock Picks with Huge Upside PotentialIn this article, we discuss billionaire Lee Cooperman’s 10 stock picks with huge upside potential. To skip the details of Mr. Cooperman’s life and investment strategy, go directly to Billionaire Lee Cooperman’s 5 Stock Picks with Huge Upside Potential. Leon Cooperman is the true definition of a “self-made” person. He was born in the South […] |

MP Price Returns

| 1-mo | 4.75% |

| 3-mo | 5.35% |

| 6-mo | -18.91% |

| 1-year | -49.37% |

| 3-year | -63.26% |

| 5-year | N/A |

| YTD | -16.62% |

| 2023 | -18.25% |

| 2022 | -46.54% |

| 2021 | 41.19% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...