Barnes Group, Inc. (B): Price and Financial Metrics

B Price/Volume Stats

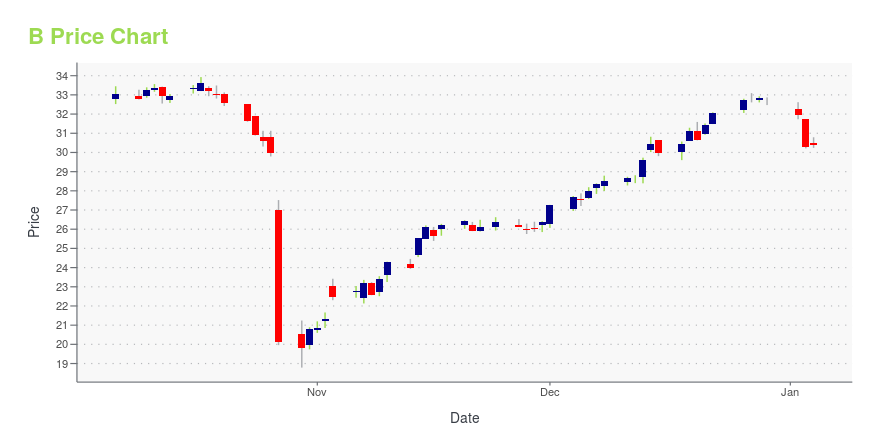

| Current price | $36.36 | 52-week high | $47.36 |

| Prev. close | $36.54 | 52-week low | $18.79 |

| Day low | $35.19 | Volume | 520,200 |

| Day high | $37.62 | Avg. volume | 379,555 |

| 50-day MA | $31.95 | Dividend yield | 1.76% |

| 200-day MA | $34.97 | Market Cap | 1.84B |

B Stock Price Chart Interactive Chart >

B POWR Grades

- Momentum is the dimension where B ranks best; there it ranks ahead of 78.23% of US stocks.

- B's strongest trending metric is Growth; it's been moving down over the last 26 weeks.

- B's current lowest rank is in the Growth metric (where it is better than 22.8% of US stocks).

B Stock Summary

- BARNES GROUP INC's stock had its IPO on January 1, 1986, making it an older stock than 92.92% of US equities in our set.

- With a year-over-year growth in debt of 135.31%, BARNES GROUP INC's debt growth rate surpasses 93.57% of about US stocks.

- Shareholder yield, a measure of how much is returned to shareholders via dividends and share repurchases, for B comes in at -44.24% -- higher than that of just 8.84% of stocks in our set.

- Stocks with similar financial metrics, market capitalization, and price volatility to BARNES GROUP INC are WHLM, HNI, AVD, UTI, and LAKE.

- B's SEC filings can be seen here. And to visit BARNES GROUP INC's official web site, go to www.barnesgroupinc.com.

B Valuation Summary

- B's price/sales ratio is 1.2; this is 42.86% lower than that of the median Industrials stock.

- Over the past 243 months, B's EV/EBIT ratio has gone up 17.

Below are key valuation metrics over time for B.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| B | 2023-12-29 | 1.2 | 1.2 | 67.9 | 33.8 |

| B | 2023-12-28 | 1.2 | 1.2 | 68.3 | 33.9 |

| B | 2023-12-27 | 1.2 | 1.2 | 68.4 | 33.9 |

| B | 2023-12-26 | 1.2 | 1.2 | 68.1 | 33.8 |

| B | 2023-12-22 | 1.2 | 1.2 | 66.7 | 33.4 |

| B | 2023-12-21 | 1.2 | 1.2 | 65.4 | 33.0 |

B Growth Metrics

- Its 2 year net income to common stockholders growth rate is now at -34.47%.

- Its year over year cash and equivalents growth rate is now at -11.36%.

- Its 4 year net cashflow from operations growth rate is now at 1.28%.

The table below shows B's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 1,261.868 | 75.559 | 13.479 |

| 2022-09-30 | 1,259.395 | 83.478 | 26.048 |

| 2022-06-30 | 1,269.71 | 90.604 | 36.932 |

| 2022-03-31 | 1,269.6 | 122.881 | 100.975 |

| 2021-12-31 | 1,258.846 | 167.806 | 99.873 |

| 2021-09-30 | 1,236.971 | 179.845 | 89.453 |

B's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- B has a Quality Grade of B, ranking ahead of 75.53% of graded US stocks.

- B's asset turnover comes in at 0.472 -- ranking 54th of 60 Construction Materials stocks.

- SNA, CSTE, and CRH are the stocks whose asset turnover ratios are most correlated with B.

The table below shows B's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.472 | 0.360 | 0.102 |

| 2021-06-30 | 0.449 | 0.353 | 0.092 |

| 2021-03-31 | 0.418 | 0.354 | 0.072 |

| 2020-12-31 | 0.427 | 0.359 | 0.081 |

| 2020-09-30 | 0.455 | 0.370 | 0.098 |

| 2020-06-30 | 0.489 | 0.376 | 0.116 |

B Price Target

For more insight on analysts targets of B, see our B price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $57.80 | Average Broker Recommendation | 1.6 (Moderate Buy) |

Barnes Group, Inc. (B) Company Bio

Barnes Group operates as an industrial and aerospace manufacturer and service provider serving a range of end markets and customers worldwide. The company operates in two segments, Industrial and Aerospace. The company was founded in 1857 and is based in Bristol, Connecticut.

Latest B News From Around the Web

Below are the latest news stories about BARNES GROUP INC that investors may wish to consider to help them evaluate B as an investment opportunity.

The Top 7 Stocks to Buy Before They Take Off Next YearThese seven blue-chip stocks to buy can form a robust core portfolio for the next leg higher in 2024 and beyond. |

The 3 Best Value Stocks Targeting at Least 25% UpsideWith growth stocks leading the market rebound this year, now is a great time to consider the best value stocks to buy for 2024. |

Apple’s Market Maneuvers: Is AAPL Stock a Smart Buy at $193?A ban on the Apple Watch could hit AAPL stock hard as the wearable is the tech stock's second biggest money-maker. |

At US$32.86, Is Barnes Group Inc. (NYSE:B) Worth Looking At Closely?Barnes Group Inc. ( NYSE:B ), might not be a large cap stock, but it received a lot of attention from a substantial... |

The 7 Highest-Yielding Dividend Gems in Warren Buffet’s CrownWarren Buffett doesn’t hide the fact he loves dividends. |

B Price Returns

| 1-mo | 17.98% |

| 3-mo | 40.33% |

| 6-mo | -5.43% |

| 1-year | -14.84% |

| 3-year | -24.52% |

| 5-year | -36.20% |

| YTD | 11.43% |

| 2023 | -18.68% |

| 2022 | -10.81% |

| 2021 | -6.88% |

| 2020 | -16.97% |

| 2019 | 16.92% |

B Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching B

Want to see what other sources are saying about Barnes Group Inc's financials and stock price? Try the links below:Barnes Group Inc (B) Stock Price | Nasdaq

Barnes Group Inc (B) Stock Quote, History and News - Yahoo Finance

Barnes Group Inc (B) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...