Vroom Inc. (VRM): Price and Financial Metrics

VRM Price/Volume Stats

| Current price | $10.51 | 52-week high | $225.60 |

| Prev. close | $13.00 | 52-week low | $10.46 |

| Day low | $10.46 | Volume | 115,200 |

| Day high | $12.95 | Avg. volume | 48,225 |

| 50-day MA | $36.66 | Dividend yield | N/A |

| 200-day MA | $81.08 | Market Cap | 18.82M |

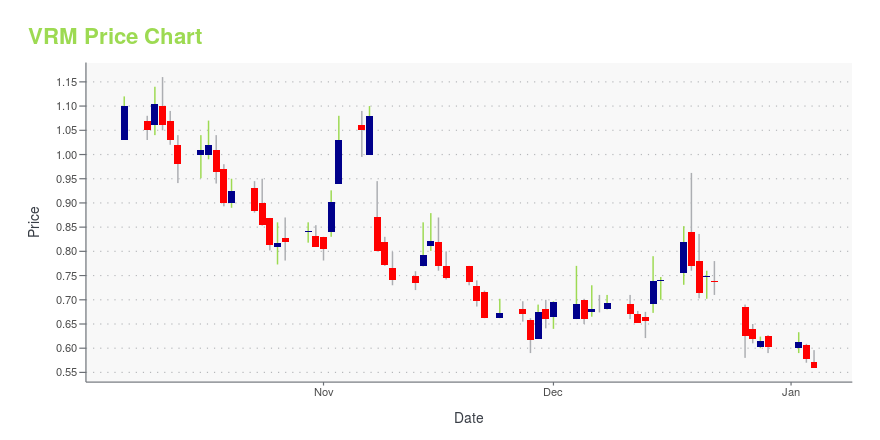

VRM Stock Price Chart Interactive Chart >

VRM POWR Grades

- Momentum is the dimension where VRM ranks best; there it ranks ahead of 43.04% of US stocks.

- The strongest trend for VRM is in Stability, which has been heading up over the past 26 weeks.

- VRM ranks lowest in Quality; there it ranks in the 1st percentile.

VRM Stock Summary

- With a one year PEG ratio of 0.55, VROOM INC is expected to have a higher PEG ratio (a measure of how expensive a stock is relative to its expected earnings growth) than only 5.25% of US stocks.

- VRM's price/sales ratio is 0.09; that's higher than the P/S ratio of merely 2.19% of US stocks.

- As for revenue growth, note that VRM's revenue has grown -67.6% over the past 12 months; that beats the revenue growth of merely 3.13% of US companies in our set.

- Stocks that are quantitatively similar to VRM, based on their financial statements, market capitalization, and price volatility, are CMLS, DLA, FNKO, ACCO, and GT.

- VRM's SEC filings can be seen here. And to visit VROOM INC's official web site, go to www.vroom.com.

VRM Valuation Summary

- In comparison to the median Consumer Cyclical stock, VRM's EV/EBIT ratio is 145.1% lower, now standing at -6.9.

- VRM's price/earnings ratio has moved up 19.5 over the prior 43 months.

Below are key valuation metrics over time for VRM.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| VRM | 2023-12-29 | 0.1 | 0.3 | -0.4 | -6.9 |

| VRM | 2023-12-28 | 0.1 | 0.3 | -0.4 | -6.9 |

| VRM | 2023-12-27 | 0.1 | 0.3 | -0.4 | -6.9 |

| VRM | 2023-12-26 | 0.1 | 0.3 | -0.4 | -6.9 |

| VRM | 2023-12-22 | 0.1 | 0.4 | -0.5 | -7.0 |

| VRM | 2023-12-21 | 0.1 | 0.4 | -0.5 | -7.0 |

VRM's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- VRM has a Quality Grade of F, ranking ahead of 3.63% of graded US stocks.

- VRM's asset turnover comes in at 1.115 -- ranking 128th of 165 Retail stocks.

- 500 - Internal server error

The table below shows VRM's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 1.115 | 0.070 | -0.435 |

| 2021-03-31 | 1.047 | 0.057 | -0.782 |

| 2020-12-31 | 1.111 | 0.053 | -0.740 |

VRM Price Target

For more insight on analysts targets of VRM, see our VRM price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $48.73 | Average Broker Recommendation | 1.53 (Moderate Buy) |

Vroom Inc. (VRM) Company Bio

Vroom, Inc. engages in providing ecommerce platform for buy and sell of used vehicles. The company operates through the following segments: Ecommerce, Texas Direct Auto (TDA), and Wholesale. The Ecommerce segment represents retail sales of used vehicles through the its ecommerce platform and fees earned on sales of value-added products associated with those vehicles sales. The TDA segment handles s retail sales of used vehicles from TDA and fees earned on sales of value-added products associated with those vehicles sales. The Wholesale segment involves in sales of used vehicles through wholesale auctions. The company was founded by Kevin P. Westfall, Elie C. Wurtman, Allon Bloch, Mike Welch, Richard Williams, and Marshall Chesrown on January 31, 2012 and is headquartered in New York, NY.

Latest VRM News From Around the Web

Below are the latest news stories about VROOM INC that investors may wish to consider to help them evaluate VRM as an investment opportunity.

Vroom Files Preliminary Proxy Statement for Reverse Stock SplitHOUSTON, December 22, 2023--Vroom, Inc. (Nasdaq: VRM) ("Vroom," the "Company," "us," "we" and "our"), a leading e-commerce platform for buying and selling used vehicles, today announced it has filed a preliminary proxy statement with the U.S. Securities and Exchange Commission (the "SEC") regarding a special stockholders’ meeting to be held on February 5, 2024, at 11:00 a.m., Eastern time (the "Special Meeting"), to authorize Vroom’s Board of Directors (the "Board") to effect a reverse stock spl |

Vroom CEO Named Executive to Watch in 2024 by Auto Finance NewsNEW YORK, December 21, 2023--Vroom, Inc. (Nasdaq: VRM), a leading e-commerce platform for buying and selling used vehicles, announced today that Tom Shortt, Chief Executive Officer, has been recognized by Auto Finance News as one of its Executives to Watch in 2024, a recognition the publication has been making based on experience, leadership, vision and ability to shake up the industry with an innovative, forward-thinking approach to auto finance. |

Vroom Announces "At The Market" (ATM) Equity Offering ProgramHOUSTON, December 01, 2023--Vroom, Inc. (Nasdaq: VRM), ("Vroom" or the "Company) a leading e-commerce platform for buying and selling used vehicles, today announced it has filed a prospectus supplement with the U.S. Securities and Exchange Commission (the "SEC") under which it may offer and sell from time to time and at its discretion shares of its common stock having an aggregate offering price of up to $50.0 million pursuant to an "at the market" offering program (the "ATM Program"). There can |

Vroom Reports Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)NEW YORK, November 22, 2023--Vroom, Inc. (Nasdaq: VRM), a leading e-commerce platform for buying and selling used vehicles, today reported that on November 18, 2023, the Compensation Committee of Vroom’s Board of Directors approved the grant of inducement restricted stock unit awards covering 96,925 shares of Vroom’s common stock to 11 employees of Vroom and its affiliates to induce them to join as employees of Vroom and its affiliates. The awards were granted under Vroom’s 2022 Inducement Award |

Vroom, Inc. (NASDAQ:VRM) Q3 2023 Earnings Call TranscriptVroom, Inc. (NASDAQ:VRM) Q3 2023 Earnings Call Transcript November 8, 2023 Operator: Good day, and thank you for standing by. Welcome to the Vroom’s Third Quarter 2023 Conference Call. At this time, all participants are in a listen only mode. After the speakers’ presentation, there will be a question-and-answer session. [Operator Instructions] Please be advised […] |

VRM Price Returns

| 1-mo | -70.06% |

| 3-mo | -81.18% |

| 6-mo | -88.87% |

| 1-year | -88.06% |

| 3-year | -99.73% |

| 5-year | N/A |

| YTD | -78.20% |

| 2023 | -40.93% |

| 2022 | -90.55% |

| 2021 | -73.66% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...