PVH Corp. (PVH): Price and Financial Metrics

PVH Price/Volume Stats

| Current price | $131.66 | 52-week high | $132.09 |

| Prev. close | $128.08 | 52-week low | $69.27 |

| Day low | $128.29 | Volume | 622,500 |

| Day high | $132.09 | Avg. volume | 792,112 |

| 50-day MA | $120.27 | Dividend yield | 0.11% |

| 200-day MA | $91.51 | Market Cap | 7.85B |

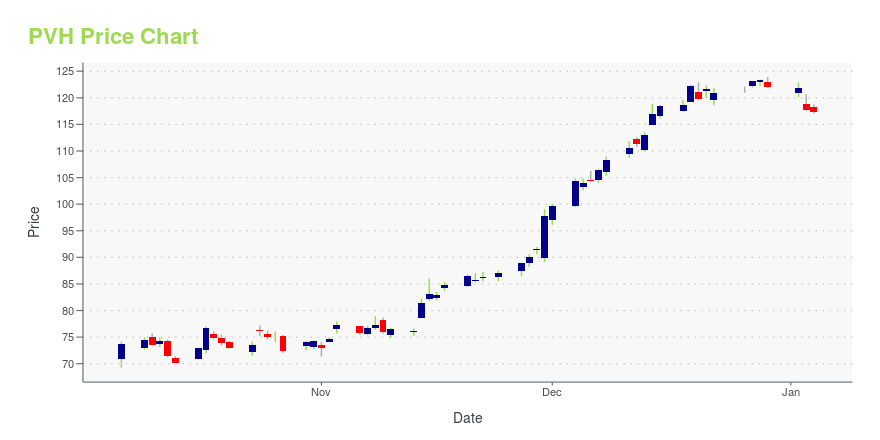

PVH Stock Price Chart Interactive Chart >

PVH POWR Grades

- Growth is the dimension where PVH ranks best; there it ranks ahead of 87.97% of US stocks.

- The strongest trend for PVH is in Value, which has been heading up over the past 26 weeks.

- PVH's current lowest rank is in the Stability metric (where it is better than 23.75% of US stocks).

PVH Stock Summary

- PVH's went public 36.51 years ago, making it older than 91.93% of listed US stocks we're tracking.

- Of note is the ratio of PVH CORP's sales and general administrative expense to its total operating expenses; 87.34% of US stocks have a lower such ratio.

- Over the past twelve months, PVH has reported earnings growth of 118.36%, putting it ahead of 91.01% of US stocks in our set.

- If you're looking for stocks that are quantitatively similar to PVH CORP, a group of peers worth examining would be AIT, SKX, SIM, COLM, and URBN.

- PVH's SEC filings can be seen here. And to visit PVH CORP's official web site, go to www.pvh.com.

PVH Valuation Summary

- PVH's price/sales ratio is 0.8; this is 0% higher than that of the median Consumer Cyclical stock.

- PVH's EV/EBIT ratio has moved up 1.3 over the prior 243 months.

Below are key valuation metrics over time for PVH.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| PVH | 2023-12-29 | 0.8 | 1.4 | 13.7 | 12.0 |

| PVH | 2023-12-28 | 0.8 | 1.5 | 13.9 | 12.1 |

| PVH | 2023-12-27 | 0.8 | 1.5 | 13.8 | 12.1 |

| PVH | 2023-12-26 | 0.8 | 1.4 | 13.7 | 12.0 |

| PVH | 2023-12-22 | 0.8 | 1.4 | 13.6 | 12.0 |

| PVH | 2023-12-21 | 0.8 | 1.4 | 13.7 | 12.0 |

PVH Growth Metrics

- Its year over year revenue growth rate is now at 16.91%.

- Its 3 year price growth rate is now at -24.59%.

- The 3 year net income to common stockholders growth rate now stands at 51.85%.

The table below shows PVH's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 8,965.2 | 212.3 | 452.5 |

| 2022-06-30 | 9,016.9 | 575.9 | 918.9 |

| 2022-03-31 | 9,198.1 | 956.9 | 985.5 |

| 2021-12-31 | 9,154.7 | 1,071.2 | 952.3 |

| 2021-09-30 | 8,814.8 | 853.9 | 503.8 |

| 2021-06-30 | 8,600.4 | 781.9 | 293.9 |

PVH's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- PVH has a Quality Grade of B, ranking ahead of 80.54% of graded US stocks.

- PVH's asset turnover comes in at 0.661 -- ranking 30th of 32 Apparel stocks.

- LEVI, RL, and VFC are the stocks whose asset turnover ratios are most correlated with PVH.

The table below shows PVH's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-08-01 | 0.661 | 0.557 | 0.080 |

| 2021-05-02 | 0.599 | 0.552 | 0.043 |

| 2021-01-31 | 0.548 | 0.530 | -0.130 |

| 2020-11-01 | 0.583 | 0.530 | -0.143 |

| 2020-08-02 | 0.610 | 0.537 | -0.125 |

| 2020-05-03 | 0.662 | 0.535 | -0.095 |

PVH Price Target

For more insight on analysts targets of PVH, see our PVH price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $129.53 | Average Broker Recommendation | 1.64 (Moderate Buy) |

PVH Corp. (PVH) Company Bio

PVH Corp., formerly known as the Phillips-Van Heusen Corporation, is an American clothing company which owns brands such as Tommy Hilfiger, Calvin Klein, Warner's, Olga and True & Co. The company also licenses brands such as Kenneth Cole New York and Michael Kors. PVH is partly named after Dutch immigrant John Manning Van Heusen, who in 1910 invented a new process that fused cloth on a curve. (Source:Wikipedia)

Latest PVH News From Around the Web

Below are the latest news stories about PVH CORP that investors may wish to consider to help them evaluate PVH as an investment opportunity.

3 Stocks to Invest in the Future of Sustainable FashionUncover investment opportunities in sustainable fashion stocks, blending innovative eco-tech with long-term financial expansion in fashion |

PVH Corp Chief People Officer Julie Fuller Sells 3,650 SharesJulie Fuller, Chief People Officer of PVH Corp (NYSE:PVH), sold 3,650 shares of the company on December 21, 2023, according to a recent SEC Filing. |

Industry Moves: Crocs Appoints John Replogle, Neeraj Tolmare to Its Board of Directors + More NewsWho's in, who's out, who's been promoted and who's been hired from across the footwear and fashion industry. |

Insider Sell Alert: CEO Martijn Hagman Offloads Shares of PVH CorpIn a notable insider transaction, Martijn Hagman, the CEO of TH Global and PVH Europe, has sold a significant number of shares in PVH Corp (NYSE:PVH). |

PVH Corp. Announces New Leadership AppointmentsNEW YORK, December 13, 2023--PVH Corp. [NYSE: PVH] today announced the appointment of Sophia Hwang-Judiesch as the President of Tommy Hilfiger North America. She joins the company on January 8, 2024 and will report to Stefan Larsson, CEO of PVH. The company also announced today that Amba Subrahmanyam will be promoted to Chief People Officer at PVH. Both leaders will join PVH’s executive leadership team and Hwang-Judiesch will also become a key member of the global TOMMY HILFIGER leadership team. |

PVH Price Returns

| 1-mo | 9.01% |

| 3-mo | 53.59% |

| 6-mo | 63.68% |

| 1-year | 59.61% |

| 3-year | 40.73% |

| 5-year | 16.27% |

| YTD | 7.81% |

| 2023 | 73.32% |

| 2022 | -33.66% |

| 2021 | 13.63% |

| 2020 | -10.61% |

| 2019 | 13.31% |

PVH Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PVH

Want to see what other sources are saying about Pvh Corp's financials and stock price? Try the links below:Pvh Corp (PVH) Stock Price | Nasdaq

Pvh Corp (PVH) Stock Quote, History and News - Yahoo Finance

Pvh Corp (PVH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...