Ingredion Incorporated (INGR): Price and Financial Metrics

INGR Price/Volume Stats

| Current price | $114.17 | 52-week high | $114.93 |

| Prev. close | $114.91 | 52-week low | $89.54 |

| Day low | $113.69 | Volume | 309,600 |

| Day high | $114.88 | Avg. volume | 391,339 |

| 50-day MA | $108.73 | Dividend yield | 2.73% |

| 200-day MA | $104.36 | Market Cap | 7.44B |

INGR Stock Price Chart Interactive Chart >

INGR POWR Grades

- Sentiment is the dimension where INGR ranks best; there it ranks ahead of 94.43% of US stocks.

- INGR's strongest trending metric is Growth; it's been moving down over the last 26 weeks.

- INGR's current lowest rank is in the Momentum metric (where it is better than 19.79% of US stocks).

INGR Stock Summary

- With a market capitalization of $7,041,438,469, INGREDION INC has a greater market value than 78.92% of US stocks.

- Of note is the ratio of INGREDION INC's sales and general administrative expense to its total operating expenses; 82.35% of US stocks have a lower such ratio.

- In terms of volatility of its share price, INGR is more volatile than merely 6.65% of stocks we're observing.

- Stocks that are quantitatively similar to INGR, based on their financial statements, market capitalization, and price volatility, are ABG, GTES, ESAB, WCC, and BLD.

- INGR's SEC filings can be seen here. And to visit INGREDION INC's official web site, go to www.ingredion.com.

INGR Valuation Summary

- In comparison to the median Consumer Defensive stock, INGR's price/sales ratio is 5.26% lower, now standing at 0.9.

- INGR's price/earnings ratio has moved down 7.4 over the prior 243 months.

Below are key valuation metrics over time for INGR.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| INGR | 2023-12-22 | 0.9 | 2.1 | 11.3 | 10.1 |

| INGR | 2023-12-21 | 0.9 | 2.1 | 11.2 | 10.1 |

| INGR | 2023-12-20 | 0.8 | 2.1 | 11.1 | 10.0 |

| INGR | 2023-12-19 | 0.9 | 2.1 | 11.2 | 10.1 |

| INGR | 2023-12-18 | 0.8 | 2.1 | 11.1 | 10.0 |

| INGR | 2023-12-15 | 0.8 | 2.1 | 11.1 | 10.0 |

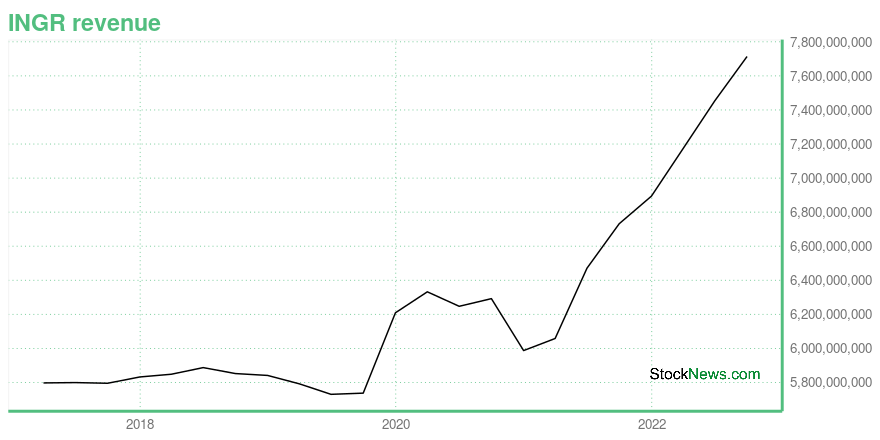

INGR Growth Metrics

- Its 3 year cash and equivalents growth rate is now at 27.06%.

- Its 4 year net cashflow from operations growth rate is now at -9.8%.

- Its year over year net income to common stockholders growth rate is now at 1725.93%.

The table below shows INGR's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 7,714 | 213 | 445 |

| 2022-06-30 | 7,454 | 259 | 457 |

| 2022-03-31 | 7,172 | 318 | 493 |

| 2021-12-31 | 6,894 | 392 | 117 |

| 2021-09-30 | 6,732 | 526 | 165 |

| 2021-06-30 | 6,471 | 664 | 139 |

INGR's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- INGR has a Quality Grade of C, ranking ahead of 50.64% of graded US stocks.

- INGR's asset turnover comes in at 0.951 -- ranking 25th of 59 Food Products stocks.

- FARM, MMMB, and LWAY are the stocks whose asset turnover ratios are most correlated with INGR.

The table below shows INGR's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.951 | 0.216 | 0.061 |

| 2021-03-31 | 0.906 | 0.215 | 0.044 |

| 2020-12-31 | 0.925 | 0.212 | 0.101 |

| 2020-09-30 | 1.004 | 0.198 | 0.102 |

| 2020-06-30 | 1.012 | 0.202 | 0.105 |

| 2020-03-31 | 1.052 | 0.208 | 0.115 |

Ingredion Incorporated (INGR) Company Bio

Ingredion manufactures and sells starches and sweeteners to various industries. It offers sweetener products comprising glucose syrups, high maltose syrups, high fructose corn syrups, caramel colors, dextrose, polyols, maltodextrins and glucose, and syrup solids, as well as food-grade and industrial starches. The company was founded in 1906 and is based in Westchester, Illinois.

Latest INGR News From Around the Web

Below are the latest news stories about INGREDION INC that investors may wish to consider to help them evaluate INGR as an investment opportunity.

Vegan Stocks to Watch: 3 Players Leading the Plant-Based RevolutionVegan stocks may have a place in your portfolio. |

Here's How Flowers Foods (FLO) Looks as We Approach 2024Flowers Foods' (FLO) strategic initiatives and brand strength keep it well-placed amid cost inflation. The company focuses on innovation and acquisitions. |

Time to Buy Kraft Heinz (KHC) and Ingredion's (INGR) Stock for ValueGenerous dividends, very reasonable valuations, and favorable outlooks certainly make Kraft Heinz (KHC) and Ingredion (INGR) two of the more attractive consumer staples stocks for the new year. |

Medifast's (MED) Holistic Health Solution, Innovation Bode WellMedifast's (MED) focus on combining lifestyle coaching with innovative health solutions and targeting diverse markets bode well amid challenges in customer acquisition and high costs. |

International Flavors (IFF) Expands Collaboration With KemiraInternational Flavors (IFF) and Kemira are set to commercialize newly designed enzymatic biomaterials. |

INGR Price Returns

| 1-mo | 3.89% |

| 3-mo | 11.53% |

| 6-mo | 13.94% |

| 1-year | 18.63% |

| 3-year | 43.49% |

| 5-year | 41.79% |

| YTD | 5.20% |

| 2023 | 14.08% |

| 2022 | 4.47% |

| 2021 | 26.35% |

| 2020 | -12.55% |

| 2019 | 4.70% |

INGR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching INGR

Here are a few links from around the web to help you further your research on Ingredion Inc's stock as an investment opportunity:Ingredion Inc (INGR) Stock Price | Nasdaq

Ingredion Inc (INGR) Stock Quote, History and News - Yahoo Finance

Ingredion Inc (INGR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...