Tyson Foods Inc. CI A (TSN): Price and Financial Metrics

TSN Price/Volume Stats

| Current price | $53.12 | 52-week high | $63.49 |

| Prev. close | $52.57 | 52-week low | $44.94 |

| Day low | $52.05 | Volume | 2,569,300 |

| Day high | $53.27 | Avg. volume | 2,823,597 |

| 50-day MA | $53.43 | Dividend yield | 3.69% |

| 200-day MA | $51.49 | Market Cap | 18.93B |

TSN Stock Price Chart Interactive Chart >

TSN POWR Grades

- Value is the dimension where TSN ranks best; there it ranks ahead of 72.56% of US stocks.

- The strongest trend for TSN is in Growth, which has been heading down over the past 26 weeks.

- TSN ranks lowest in Growth; there it ranks in the 5th percentile.

TSN Stock Summary

- TSN has a market capitalization of $19,399,647,062 -- more than approximately 88.95% of US stocks.

- TYSON FOODS INC's stock had its IPO on July 9, 1986, making it an older stock than 92.45% of US equities in our set.

- With a price/sales ratio of 0.37, TYSON FOODS INC has a higher such ratio than merely 11.96% of stocks in our set.

- Stocks that are quantitatively similar to TSN, based on their financial statements, market capitalization, and price volatility, are KBR, MHK, NWL, DNUT, and BRP.

- Visit TSN's SEC page to see the company's official filings. To visit the company's web site, go to www.tysonfoods.com.

TSN Valuation Summary

- In comparison to the median Consumer Defensive stock, TSN's price/sales ratio is 68.42% lower, now standing at 0.3.

- TSN's price/earnings ratio has moved down 42.3 over the prior 243 months.

Below are key valuation metrics over time for TSN.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| TSN | 2023-12-22 | 0.3 | 1 | -28.5 | -85.0 |

| TSN | 2023-12-21 | 0.3 | 1 | -28.3 | -84.7 |

| TSN | 2023-12-20 | 0.3 | 1 | -28.0 | -84.2 |

| TSN | 2023-12-19 | 0.3 | 1 | -28.4 | -84.9 |

| TSN | 2023-12-18 | 0.3 | 1 | -28.3 | -84.8 |

| TSN | 2023-12-15 | 0.3 | 1 | -28.4 | -84.9 |

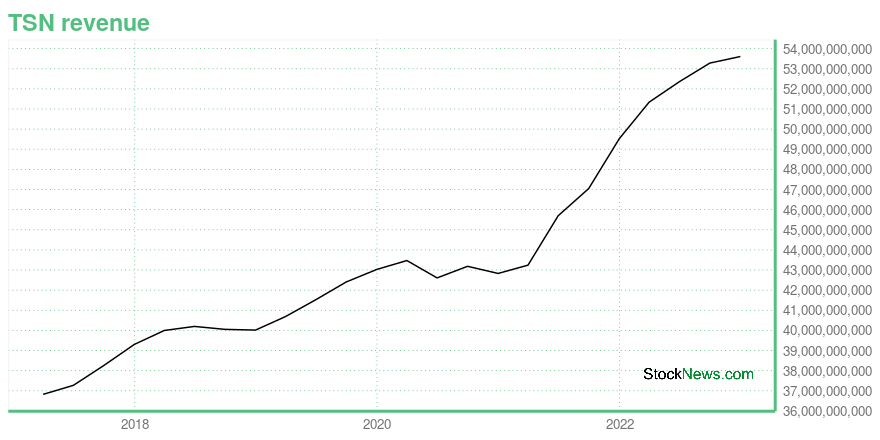

TSN Growth Metrics

- The 2 year price growth rate now stands at 67.82%.

- Its year over year revenue growth rate is now at 18.72%.

- The 5 year net income to common stockholders growth rate now stands at 8.74%.

The table below shows TSN's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 53,609 | 2,017 | 2,433 |

| 2022-09-30 | 53,282 | 2,687 | 3,238 |

| 2022-06-30 | 52,356 | 3,074 | 4,055 |

| 2022-03-31 | 51,339 | 3,715 | 4,054 |

| 2021-12-31 | 49,522 | 3,887 | 3,701 |

| 2021-09-30 | 47,049 | 3,840 | 3,047 |

TSN's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- TSN has a Quality Grade of C, ranking ahead of 52.69% of graded US stocks.

- TSN's asset turnover comes in at 1.303 -- ranking 15th of 58 Food Products stocks.

- LNDC, FLO, and LANC are the stocks whose asset turnover ratios are most correlated with TSN.

The table below shows TSN's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-07-03 | 1.303 | 0.124 | 0.156 |

| 2021-04-03 | 1.242 | 0.124 | 0.140 |

| 2021-01-02 | 1.236 | 0.120 | 0.132 |

| 2020-10-03 | 1.261 | 0.125 | 0.143 |

| 2020-06-27 | 1.259 | 0.115 | 0.126 |

| 2020-03-28 | 1.293 | 0.114 | 0.130 |

TSN Price Target

For more insight on analysts targets of TSN, see our TSN price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $85.75 | Average Broker Recommendation | 1.57 (Moderate Buy) |

Tyson Foods Inc. CI A (TSN) Company Bio

Tyson Foods, Inc. is an American multinational corporation based in Springdale, Arkansas, that operates in the food industry. The company is the world's second largest processor and marketer of chicken, beef, and pork after JBS S.A. and annually exports the largest percentage of beef out of the United States. Together with its subsidiaries, it operates major food brands, including Jimmy Dean, Hillshire Farm, Ball Park, Wright Brand, Aidells, and State Fair. Tyson Foods ranked No. 79 in the 2020 Fortune 500 list of the largest United States corporations by total revenue. (Source:Wikipedia)

Latest TSN News From Around the Web

Below are the latest news stories about TYSON FOODS INC that investors may wish to consider to help them evaluate TSN as an investment opportunity.

The 500 Top Stocks to Buy for 2024, Ranked by AIThese are the very best stocks to buy for 2024 for any investor, according to Tom Yeung's MarketMasterAI system. |

Beyond Meat founder and CEO: The arc of history is on our sideIt's not easy to change a well-entrenched industry, something Yahoo Finance was reminded of when sitting down with Beyond Meat's founder and CEO Ethan Brown. |

Beyond Meat: How the plant-based CEO leads an uphill battleEthan Brown is one of the leaders taking on the meat industry, as Founder and CEO of Beyond Meat (BYND). Brown has managed to make deals with brands like Target (TGT) and Dunkin Donuts, and in May of 2019 he took the company public as part of the plant-based meat boom. Brown invited Yahoo Finance Executive Editor Brian Sozzi to Beyond Meat headquarters in El Segundo, CA to share insights on what it takes to lead the company through the challenges of competing in the meat industry and the qualities that keep him going, like building a trustworthy team, focusing on the company’s true mission of changing how consumers consume meat, and embracing failure along the way. “We have to figure out how to get people comfortable with quick iteration, quick failure, and then quick recovery,” says Br... |

15 Highest Quality Steakhouse Chains In The USIn this article, we shall discuss the 15 highest quality steakhouse chains in the US. To skip our detailed analysis of the global meat industry and a brief overview of the restaurant industry in 2023, go directly and see 5 Highest Quality Steakhouse Chains in the US. According to a market research report by the […] |

3 Undervalued Stocks That Just Raised Their DividendThese undervalued dividend stocks have a bright future ahead. |

TSN Price Returns

| 1-mo | 0.04% |

| 3-mo | 11.88% |

| 6-mo | 1.28% |

| 1-year | -10.22% |

| 3-year | -14.50% |

| 5-year | -4.95% |

| YTD | -1.17% |

| 2023 | -10.44% |

| 2022 | -26.90% |

| 2021 | 38.47% |

| 2020 | -27.35% |

| 2019 | 73.91% |

TSN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching TSN

Here are a few links from around the web to help you further your research on Tyson Foods Inc's stock as an investment opportunity:Tyson Foods Inc (TSN) Stock Price | Nasdaq

Tyson Foods Inc (TSN) Stock Quote, History and News - Yahoo Finance

Tyson Foods Inc (TSN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...