Post Holdings, Inc. (POST): Price and Financial Metrics

POST Price/Volume Stats

| Current price | $105.39 | 52-week high | $106.75 |

| Prev. close | $105.54 | 52-week low | $78.85 |

| Day low | $104.09 | Volume | 767,200 |

| Day high | $105.54 | Avg. volume | 847,961 |

| 50-day MA | $93.62 | Dividend yield | N/A |

| 200-day MA | $87.95 | Market Cap | 6.40B |

POST Stock Price Chart Interactive Chart >

POST POWR Grades

- Value is the dimension where POST ranks best; there it ranks ahead of 72.93% of US stocks.

- POST's strongest trending metric is Growth; it's been moving down over the last 26 weeks.

- POST's current lowest rank is in the Sentiment metric (where it is better than 12.87% of US stocks).

POST Stock Summary

- The ratio of debt to operating expenses for POST HOLDINGS INC is higher than it is for about 81.55% of US stocks.

- Revenue growth over the past 12 months for POST HOLDINGS INC comes in at 19.48%, a number that bests 75.94% of the US stocks we're tracking.

- In terms of volatility of its share price, POST is more volatile than merely 0.35% of stocks we're observing.

- Stocks with similar financial metrics, market capitalization, and price volatility to POST HOLDINGS INC are TPB, EEFT, OLPX, PRFT, and SPLP.

- Visit POST's SEC page to see the company's official filings. To visit the company's web site, go to www.postholdings.com.

POST Valuation Summary

- In comparison to the median Consumer Defensive stock, POST's price/earnings ratio is 14.83% lower, now standing at 17.8.

- POST's EV/EBIT ratio has moved up 22 over the prior 145 months.

Below are key valuation metrics over time for POST.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| POST | 2023-12-22 | 0.8 | 1.4 | 17.8 | 16.6 |

| POST | 2023-12-21 | 0.8 | 1.4 | 17.7 | 16.5 |

| POST | 2023-12-20 | 0.8 | 1.4 | 17.5 | 16.4 |

| POST | 2023-12-19 | 0.8 | 1.4 | 17.7 | 16.6 |

| POST | 2023-12-18 | 0.8 | 1.4 | 17.7 | 16.5 |

| POST | 2023-12-15 | 0.8 | 1.4 | 17.5 | 16.4 |

POST Growth Metrics

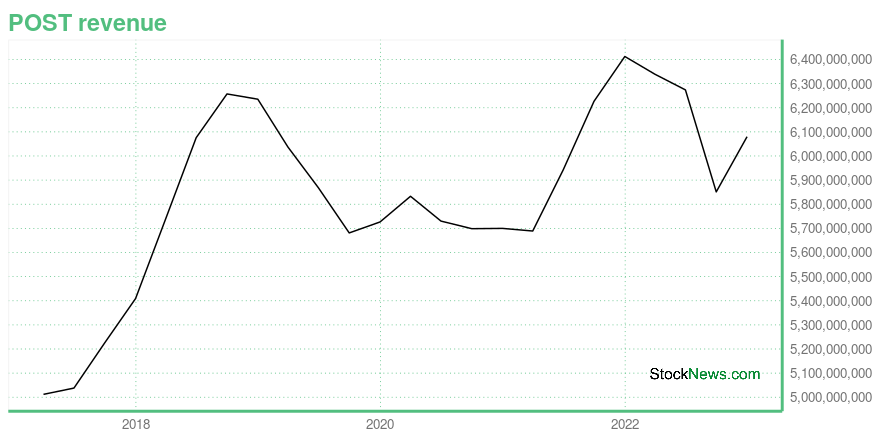

- The 4 year revenue growth rate now stands at 16.38%.

- The 2 year net cashflow from operations growth rate now stands at -0.75%.

- Its 2 year price growth rate is now at -9.92%.

The table below shows POST's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 6,080 | 374.8 | 869.3 |

| 2022-09-30 | 5,851.2 | 382.6 | 756.6 |

| 2022-06-30 | 6,273.9 | 411 | 702.6 |

| 2022-03-31 | 6,338.8 | 567.9 | 478.1 |

| 2021-12-31 | 6,412.4 | 579.8 | 64.7 |

| 2021-09-30 | 6,226.7 | 588.2 | 166.7 |

POST's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- POST has a Quality Grade of C, ranking ahead of 25.66% of graded US stocks.

- POST's asset turnover comes in at 0.485 -- ranking 45th of 59 Food Products stocks.

- HAIN, SJM, and FRPT are the stocks whose asset turnover ratios are most correlated with POST.

The table below shows POST's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.485 | 0.307 | 0.069 |

| 2021-03-31 | 0.471 | 0.313 | 0.078 |

| 2020-12-31 | 0.471 | 0.311 | 0.038 |

| 2020-09-30 | 0.472 | 0.314 | 0.042 |

| 2020-06-30 | 0.477 | 0.314 | 0.023 |

| 2020-03-31 | 0.491 | 0.313 | 0.020 |

Post Holdings, Inc. (POST) Company Bio

Post Holdings manufactures, markets, and sells refrigerated, active nutrition, and private label food products in the United States and Canada. The company operates through five segments: Post Foods, Michael Foods, Active Nutrition, Private Brands, and Attune Foods. The company was founded in 1895 and is based in St. Louis, Missouri.

Latest POST News From Around the Web

Below are the latest news stories about POST HOLDINGS INC that investors may wish to consider to help them evaluate POST as an investment opportunity.

Consumer Staples Sector Outlook: 3 Major Shifts Anticipated in 2024The consumer staples trends in 2024 suggest that business could be much better in 2024 due to higher volumes and elevated prices. |

Post Holdings Issues 2023 Environmental, Social and Governance ReportST. LOUIS, Dec. 14, 2023 (GLOBE NEWSWIRE) -- Post Holdings, Inc. (NYSE:POST), a consumer packaged goods holding company, today released its 2023 Environmental, Social and Governance (ESG) report. The report details Post’s enterprise-wide approach and progress with integrating ESG considerations across four strategic pillars: Sourcing, Operational, Product and Social, including spotlighting unique initiatives within each operating company. In fiscal year 2023, Post made meaningful progress across |

Post Holdings (POST) Ups Adjusted EBITDA View on Latest BuyoutPost Holdings (POST) updates its adjusted EBITDA guidance for fiscal 2024, which includes contributions from the Perfection Pet Foods acquisition. |

Post Holdings Reports Avian Influenza at Third-Party Contracted Facilities and Updates Fiscal Year 2024 Adjusted EBITDA OutlookST. LOUIS, Dec. 07, 2023 (GLOBE NEWSWIRE) -- Post Holdings, Inc. (NYSE:POST), a consumer packaged goods holding company, today provided information regarding avian influenza incidents at two of Michael Foods’ third-party contracted egg-laying facilities. Post also updated its non-GAAP Adjusted EBITDA guidance for fiscal year 2024. Avian Influenza Discussion Michael Foods’ third-party contracted egg-laying flocks in Iowa and Ohio tested positive for avian influenza. The facilities house approxima |

Post Holdings (POST) Buys Perfection Pet Foods, Boosts PortfolioPost Holdings (POST) acquires Perfection Pet Foods, enhancing its manufacturing capabilities and diversifying into the pet food space. |

POST Price Returns

| 1-mo | 14.36% |

| 3-mo | 22.67% |

| 6-mo | 19.61% |

| 1-year | 14.58% |

| 3-year | 61.81% |

| 5-year | 53.90% |

| YTD | 19.68% |

| 2023 | -2.44% |

| 2022 | 20.10% |

| 2021 | 11.60% |

| 2020 | -7.42% |

| 2019 | 22.41% |

Continue Researching POST

Want to do more research on Post Holdings Inc's stock and its price? Try the links below:Post Holdings Inc (POST) Stock Price | Nasdaq

Post Holdings Inc (POST) Stock Quote, History and News - Yahoo Finance

Post Holdings Inc (POST) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...