US Foods Holding Corp. (USFD): Price and Financial Metrics

USFD Price/Volume Stats

| Current price | $49.58 | 52-week high | $49.87 |

| Prev. close | $48.57 | 52-week low | $33.96 |

| Day low | $48.27 | Volume | 4,598,500 |

| Day high | $49.87 | Avg. volume | 1,795,433 |

| 50-day MA | $45.86 | Dividend yield | N/A |

| 200-day MA | $42.13 | Market Cap | 12.19B |

USFD Stock Price Chart Interactive Chart >

USFD POWR Grades

- Value is the dimension where USFD ranks best; there it ranks ahead of 90.82% of US stocks.

- The strongest trend for USFD is in Growth, which has been heading down over the past 26 weeks.

- USFD ranks lowest in Quality; there it ranks in the 58th percentile.

USFD Stock Summary

- US FOODS HOLDING CORP's capital turnover -- a measure of revenue relative to shareholder's equity -- is better than 94.74% of US listed stocks.

- With a price/sales ratio of 0.32, US FOODS HOLDING CORP has a higher such ratio than merely 10.04% of stocks in our set.

- In terms of volatility of its share price, USFD is more volatile than merely 12.79% of stocks we're observing.

- Stocks with similar financial metrics, market capitalization, and price volatility to US FOODS HOLDING CORP are EME, MAN, DKS, POOL, and RHI.

- USFD's SEC filings can be seen here. And to visit US FOODS HOLDING CORP's official web site, go to www.usfoods.com.

USFD Valuation Summary

- In comparison to the median Consumer Defensive stock, USFD's price/sales ratio is 84.21% lower, now standing at 0.3.

- USFD's price/sales ratio has moved up 0.1 over the prior 90 months.

Below are key valuation metrics over time for USFD.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| USFD | 2023-12-22 | 0.3 | 2.4 | 25.5 | 16.9 |

| USFD | 2023-12-21 | 0.3 | 2.4 | 25.4 | 16.9 |

| USFD | 2023-12-20 | 0.3 | 2.3 | 25.1 | 16.8 |

| USFD | 2023-12-19 | 0.3 | 2.3 | 25.2 | 16.8 |

| USFD | 2023-12-18 | 0.3 | 2.3 | 24.9 | 16.6 |

| USFD | 2023-12-15 | 0.3 | 2.3 | 24.6 | 16.5 |

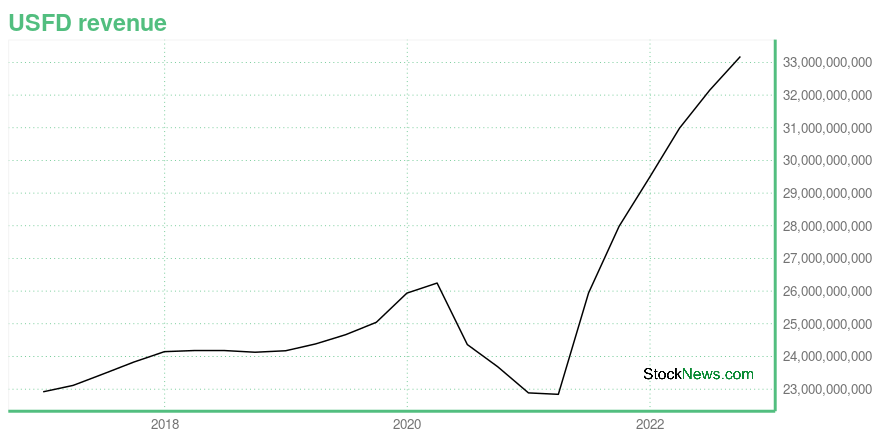

USFD Growth Metrics

- Its 2 year price growth rate is now at 73.73%.

- Its 2 year net income to common stockholders growth rate is now at -20.88%.

- Its year over year net income to common stockholders growth rate is now at 189.44%.

The table below shows USFD's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 33,181 | 512 | 204 |

| 2022-06-30 | 32,154 | 428 | 159 |

| 2022-03-31 | 30,990 | 401 | 144 |

| 2021-12-31 | 29,487 | 419 | 121 |

| 2021-09-30 | 27,986 | 400 | 39 |

| 2021-06-30 | 25,944 | -107 | -18 |

USFD's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- USFD has a Quality Grade of C, ranking ahead of 50.55% of graded US stocks.

- USFD's asset turnover comes in at 2.024 -- ranking 36th of 105 Wholesale stocks.

- WEYS, LAWS, and SYY are the stocks whose asset turnover ratios are most correlated with USFD.

The table below shows USFD's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-07-03 | 2.024 | 0.160 | 0.029 |

| 2021-04-03 | 1.766 | 0.160 | 0.009 |

| 2021-01-02 | 1.804 | 0.163 | -0.006 |

| 2020-09-26 | 1.910 | 0.167 | 0.010 |

| 2020-06-27 | 2.017 | 0.170 | 0.022 |

| 2020-03-28 | 2.379 | 0.175 | 0.056 |

US Foods Holding Corp. (USFD) Company Bio

US Foods, Inc. operates as a foodservice distributor in the United States It offers a range of fresh, frozen and dry food, and non-food products. The company was formerly known as U.S. Foodservice, Inc. and changed its name to US Foods, Inc. in September 2011. US Foods, Inc. was founded in 1853 and is based in Rosemont, Illinois.

Latest USFD News From Around the Web

Below are the latest news stories about US FOODS HOLDING CORP that investors may wish to consider to help them evaluate USFD as an investment opportunity.

US Foods to Present at the 2024 ICR ConferenceROSEMONT, Ill., December 28, 2023--US Foods Holding Corp. (NYSE: USFD) announced today that Dave Flitman, Chief Executive Officer, and Dirk Locascio, Chief Financial Officer, will participate in a fireside chat at the ICR Conference in Orlando on Monday, Jan. 8 at 2:00 p.m. EST (1:00 p.m. CST). |

US Foods Donates More Than $12 Million in 2023 to Address Hunger-Relief EffortsROSEMONT, Ill., December 19, 2023--US Foods Holding Corp. (NYSE: USFD), one of America’s largest foodservice distributors, announced today that the company and its associates have donated more than $12 million in food, supplies and monetary contributions to address hunger-relief efforts across the country throughout 2023, the equivalent of approximately 5 million meals or approximately 225 truckloads of product, through its corporate hunger-relief campaigns. |

Should You Buy US Foods (USFD) After Golden Cross?Is it a good or bad thing when a stock experiences a golden cross technical event? |

12 Stocks Billionaire Larry Robbins Just Bought and SoldIn this piece, we will take a look at the 12 stocks that billionaire Larry Robbins just bought and sold. If you want to skip our introduction to the billionaire hedge fund boss and the latest stock market news, then take a look at 5 Stocks Billionaire Larry Robbins Just Bought and Sold. Larry Robbins […] |

US Foods Holding Corp. (NYSE:USFD) Q3 2023 Earnings Call TranscriptUS Foods Holding Corp. (NYSE:USFD) Q3 2023 Earnings Call Transcript November 9, 2023 US Foods Holding Corp. beats earnings expectations. Reported EPS is $0.7, expectations were $0.69. Operator: Good day, everyone, and welcome to the US Foods Third Quarter 2023 Quarterly Earnings Call. Today’s call is being recorded. And I would now like to turn […] |

USFD Price Returns

| 1-mo | 7.78% |

| 3-mo | 16.93% |

| 6-mo | 21.79% |

| 1-year | 25.17% |

| 3-year | 36.17% |

| 5-year | 39.66% |

| YTD | 9.18% |

| 2023 | 33.48% |

| 2022 | -2.33% |

| 2021 | 4.56% |

| 2020 | -20.48% |

| 2019 | 32.40% |

Continue Researching USFD

Want to do more research on US Foods Holding Corp's stock and its price? Try the links below:US Foods Holding Corp (USFD) Stock Price | Nasdaq

US Foods Holding Corp (USFD) Stock Quote, History and News - Yahoo Finance

US Foods Holding Corp (USFD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...