Fresh Del Monte Produce, Inc. (FDP): Price and Financial Metrics

FDP Price/Volume Stats

| Current price | $23.77 | 52-week high | $32.49 |

| Prev. close | $24.16 | 52-week low | $21.41 |

| Day low | $23.76 | Volume | 186,300 |

| Day high | $24.07 | Avg. volume | 219,782 |

| 50-day MA | $25.15 | Dividend yield | 3.37% |

| 200-day MA | $25.59 | Market Cap | 1.14B |

FDP Stock Price Chart Interactive Chart >

FDP POWR Grades

- FDP scores best on the Sentiment dimension, with a Sentiment rank ahead of 90.43% of US stocks.

- The strongest trend for FDP is in Stability, which has been heading down over the past 26 weeks.

- FDP's current lowest rank is in the Momentum metric (where it is better than 0.83% of US stocks).

FDP Stock Summary

- Of note is the ratio of FRESH DEL MONTE PRODUCE INC's sales and general administrative expense to its total operating expenses; 99.23% of US stocks have a lower such ratio.

- With a price/sales ratio of 0.3, FRESH DEL MONTE PRODUCE INC has a higher such ratio than merely 9.47% of stocks in our set.

- In terms of twelve month growth in earnings before interest and taxes, FRESH DEL MONTE PRODUCE INC is reporting a growth rate of 75.26%; that's higher than 86.97% of US stocks.

- If you're looking for stocks that are quantitatively similar to FRESH DEL MONTE PRODUCE INC, a group of peers worth examining would be TRS, EBF, LINC, ROAD, and TWIN.

- Visit FDP's SEC page to see the company's official filings. To visit the company's web site, go to www.freshdelmonte.com.

FDP Valuation Summary

- FDP's EV/EBIT ratio is 10.3; this is 40.97% lower than that of the median Consumer Defensive stock.

- Over the past 243 months, FDP's price/earnings ratio has gone up 4.1.

Below are key valuation metrics over time for FDP.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| FDP | 2023-12-22 | 0.3 | 0.6 | 11.1 | 10.3 |

| FDP | 2023-12-21 | 0.3 | 0.6 | 11.0 | 10.3 |

| FDP | 2023-12-20 | 0.3 | 0.6 | 10.8 | 10.2 |

| FDP | 2023-12-19 | 0.3 | 0.6 | 10.9 | 10.2 |

| FDP | 2023-12-18 | 0.3 | 0.6 | 10.7 | 10.1 |

| FDP | 2023-12-15 | 0.3 | 0.6 | 10.6 | 10.0 |

FDP Growth Metrics

- Its 5 year net income to common stockholders growth rate is now at -77.13%.

- The year over year net cashflow from operations growth rate now stands at -63.85%.

- Its 3 year net income to common stockholders growth rate is now at 331.14%.

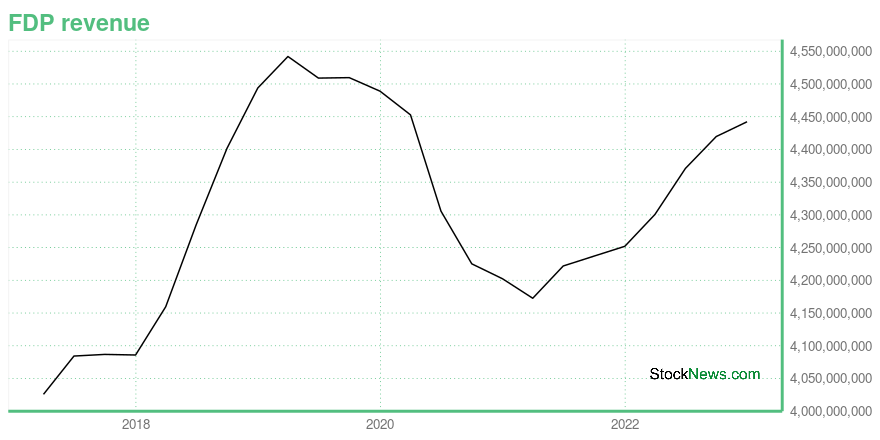

The table below shows FDP's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 4,442.3 | 61.8 | 98.6 |

| 2022-09-30 | 4,419.7 | 82.6 | 69.1 |

| 2022-06-30 | 4,371 | 84.1 | 37.1 |

| 2022-03-31 | 4,300.7 | 81.4 | 63.1 |

| 2021-12-31 | 4,252 | 128.5 | 80 |

| 2021-09-30 | 4,237 | 158.3 | 92.1 |

FDP's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- FDP has a Quality Grade of C, ranking ahead of 56.48% of graded US stocks.

- FDP's asset turnover comes in at 1.253 -- ranking 3rd of 16 Agriculture stocks.

- SITE, SISI, and CVGW are the stocks whose asset turnover ratios are most correlated with FDP.

The table below shows FDP's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-10-01 | 1.253 | 0.071 | 0.041 |

| 2021-07-02 | 1.258 | 0.075 | 0.051 |

| 2021-04-02 | 1.251 | 0.069 | 0.041 |

| 2021-01-01 | 1.262 | 0.060 | 0.026 |

| 2020-09-25 | 1.269 | 0.059 | 0.019 |

| 2020-06-26 | 1.287 | 0.060 | 0.019 |

FDP Price Target

For more insight on analysts targets of FDP, see our FDP price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $38.33 | Average Broker Recommendation | 1.5 (Moderate Buy) |

Fresh Del Monte Produce, Inc. (FDP) Company Bio

Fresh Del Monte Produce is one of the world's leading vertically integrated producers, marketers and distributors of high-quality fresh and fresh-cut fruit and vegetables, as well as a leading producer and distributor of prepared food in Europe, Africa, the Middle East and the countries formerly part of the Soviet Union. The company was founded in 1886 and is based in Coral Gables, Florida.

Latest FDP News From Around the Web

Below are the latest news stories about FRESH DEL MONTE PRODUCE INC that investors may wish to consider to help them evaluate FDP as an investment opportunity.

Fresh Del Monte Produce Inc. Announces Participation in the 2024 ICR ConferenceCORAL GABLES, Fla., December 26, 2023--Fresh Del Monte Produce Inc. (NYSE: FDP) today announced that management will participate in the 2024 ICR Conference, to be held at the JW Marriott Orlando Lakes in Orlando, FL from January 8-10, 2024. Monica Vicente, Senior Vice President and Chief Financial Officer, and Bianca Hernandez, Senior Manager of Investor Relations, will hold meetings with institutional investors on Monday, January 8 and Tuesday, January 9, 2024. |

A fantastic week for Fresh Del Monte Produce Inc.'s (NYSE:FDP) 64% institutional owners, one-year returns continue to impressKey Insights Significantly high institutional ownership implies Fresh Del Monte Produce's stock price is sensitive to... |

15 Most Consumed Vegetables in the USIn this article, we will be taking a look at the 15 most consumed vegetables in the U.S. To skip our detailed analysis, you can go directly to see the 5 most consumed vegetables in the U.S. The fruit and vegetable industry in the U.S. is worth more than $96 billion, according to Grand View […] |

Fresh Del Monte: A Cheap but Cyclical StockThe low-risk stock has an outstanding valuation near cyclical lows |

Fresh Del Monte Produce Inc. Names New Independent Board MemberCORAL GABLES, Fla., December 04, 2023--Fresh Del Monte Produce Inc. (NYSE: FDP) today announced the appointment of Ajai Puri, a seasoned expert with decades of experience in the food and beverage industry, to its board of directors, effective February 19, 2024. |

FDP Price Returns

| 1-mo | -4.92% |

| 3-mo | 2.50% |

| 6-mo | -8.15% |

| 1-year | -14.58% |

| 3-year | 1.11% |

| 5-year | -6.06% |

| YTD | -9.45% |

| 2023 | 3.87% |

| 2022 | -2.98% |

| 2021 | 16.50% |

| 2020 | -30.34% |

| 2019 | 24.32% |

FDP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching FDP

Want to see what other sources are saying about Fresh Del Monte Produce Inc's financials and stock price? Try the links below:Fresh Del Monte Produce Inc (FDP) Stock Price | Nasdaq

Fresh Del Monte Produce Inc (FDP) Stock Quote, History and News - Yahoo Finance

Fresh Del Monte Produce Inc (FDP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...