LiveOne Inc. (LVO): Price and Financial Metrics

LVO Price/Volume Stats

| Current price | $1.45 | 52-week high | $2.19 |

| Prev. close | $1.44 | 52-week low | $0.78 |

| Day low | $1.43 | Volume | 178,600 |

| Day high | $1.54 | Avg. volume | 206,733 |

| 50-day MA | $1.30 | Dividend yield | N/A |

| 200-day MA | $1.36 | Market Cap | 132.90M |

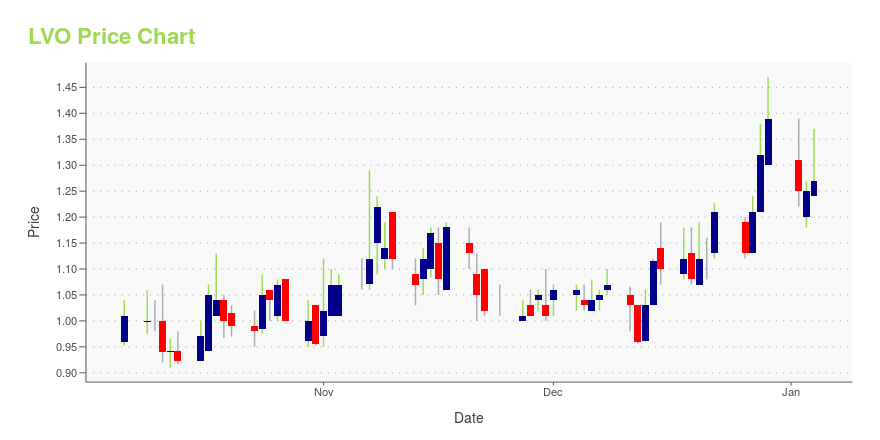

LVO Stock Price Chart Interactive Chart >

LVO POWR Grades

- Momentum is the dimension where LVO ranks best; there it ranks ahead of 65.22% of US stocks.

- The strongest trend for LVO is in Quality, which has been heading down over the past 26 weeks.

- LVO's current lowest rank is in the Quality metric (where it is better than 21.72% of US stocks).

LVO Stock Summary

- LIVEONE INC's capital turnover -- a measure of revenue relative to shareholder's equity -- is better than just 0.94% of US listed stocks.

- LVO's equity multiplier -- a measure of assets relative to shareholders'equity -- is greater than that of only 2.11% of US stocks.

- With a year-over-year growth in debt of -70.29%, LIVEONE INC's debt growth rate surpasses merely 2.68% of about US stocks.

- Stocks that are quantitatively similar to LVO, based on their financial statements, market capitalization, and price volatility, are ATEC, PTON, SIEN, OGN, and RDW.

- LVO's SEC filings can be seen here. And to visit LIVEONE INC's official web site, go to www.livexlive.com.

LVO Valuation Summary

- In comparison to the median Communication Services stock, LVO's EV/EBIT ratio is 181.73% lower, now standing at -13.2.

- Over the past 71 months, LVO's price/sales ratio has gone down 857.

Below are key valuation metrics over time for LVO.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| LVO | 2023-12-29 | 1.2 | -21.2 | -7.9 | -13.2 |

| LVO | 2023-12-28 | 1.1 | -20.1 | -7.5 | -12.6 |

| LVO | 2023-12-27 | 1.0 | -18.5 | -6.9 | -11.6 |

| LVO | 2023-12-26 | 0.9 | -17.2 | -6.4 | -10.8 |

| LVO | 2023-12-22 | 1.0 | -18.5 | -6.9 | -11.6 |

| LVO | 2023-12-21 | 1.0 | -17.4 | -6.5 | -10.9 |

LiveOne Inc. (LVO) Company Bio

LiveXLive Media, Inc. is a digital media company, which engages in the acquisition, distribution, and monetization of live music, Internet radio, podcasting, and music-related streaming and video content. It operates LiveXLive, a live music streaming platform; and Slacker Radio, a streaming music service, as well as produces original music-related content. The company produces, edits, curates, and streams live music events through broadband transmission over the Internet and satellite networks to its users; provides digital Internet radio and music services to users online and through original equipment manufacturers on a white label basis; and offers ancillary products and services, such as regulatory and post-implementation support services. It also offers an application that provides access to live events, audio streams, original episodic content, podcasts, video on demand, real-time livestreams, and social sharing of content. The Company was founded on December 28, 2009 by Robert Scott Ellin and is headquartered in Beverly Hills, CA.

Latest LVO News From Around the Web

Below are the latest news stories about LIVEONE INC that investors may wish to consider to help them evaluate LVO as an investment opportunity.

PodcastOne (NASDAQ: PODC) Acquires Exclusive Rights to Hit Podcast Was I In A Cult? From Hosts Liz Iacuzzi and Tyler MeasomWebby Award Winning Podcast Boasts Nearly 9 Million Downloads, 32 Episodes Since 2021 Launch Was I In A Cult? is the 22nd Podcast Added to the PodcastOne Network in 2023 LOS ANGELES, CA, Dec. 20, 2023 (GLOBE NEWSWIRE) -- via NewMediaWire – PodcastOne (NASDAQ: PODC), a leading podcast platform and a subsidiary of LiveOne (NASDAQ: LVO), which owns ~80% of the PODC outstanding common stock, announced today that is has acquired the exclusive distribution and sales rights to the critically acclaimed |

LiveOne (Nasdaq: LVO) Issues Fiscal 2025 Revenue Guidance of $140 - $155M with $16 - $20M of Adjusted EBITDA*- Audio Division, consisting of Slacker Radio and PodcastOne (Nasdaq: PODC), forecasts to combine for $130 - $140M of revenues with $20 - $25M EBITDA* and over $17M of positive cash flow - Anticipates LiveOne to add over 1M subscribers - Expects PodcastOne to onboard 20+ new podcasters - Expands LiveOne stock repurchase program to $10M - Currently finalizing the restructuring of the merchandise business slashing 75-100 staff expected to result in $5 - $10m cost savings, with focus on key custome |

7 Promising Penny Stocks With the Potential to Defy ExpectationsYou know you want it. |

LiveOne (Nasdaq: LVO) Signs Strategic B2B Partnership With Fortune 500 Media Conglomerate; Partnership Delivers Minimum $20 Million Revenues for Calendar 2024- Company Raises Revenue Guidance for Fiscal 2024 ending March 31, 2024 to $118M - $120M - Increases Current Pipeline to Over 35 Potential B2B Partnerships Across 8 Verticals LOS ANGELES, CA, Dec. 15, 2023 (GLOBE NEWSWIRE) -- via NewMediaWire –LiveOne (Nasdaq: LVO), an award-winning, creator-first music, entertainment, and technology platform, announced today a new significant partnership agreement as well as updated revenue guidance for its current fiscal year ending March 31, 2024 (“Fiscal 202 |

LiveOne Plans to Cut an Additional 25% of Staff by Year-End With a Continued Focus on Utilizing AI- Slashing Additional $7.5M - $10M of Costs Expected to Bring Total Savings to Over $40 Million - Continues to Consolidate and Shed Non-Core Business Units and Focus on AI Technologies to Drive Engagement and Boost Margins Leading to Greater Monetization of Talent Across Vertically Integrated Divisions - Short-Term Assets of $27 Million and $10 Million Cash LOS ANGELES, CA, Dec. 14, 2023 (GLOBE NEWSWIRE) -- via NewMediaWire – LiveOne (Nasdaq: LVO), an award-winning, creator-first music, entertai |

LVO Price Returns

| 1-mo | 9.02% |

| 3-mo | 38.10% |

| 6-mo | -14.71% |

| 1-year | 28.32% |

| 3-year | -67.99% |

| 5-year | -74.56% |

| YTD | 4.32% |

| 2023 | 116.01% |

| 2022 | -49.73% |

| 2021 | -60.98% |

| 2020 | 112.30% |

| 2019 | -68.79% |

Loading social stream, please wait...