Chicken Soup for the Soul Entertainment, Inc. - (CSSE): Price and Financial Metrics

CSSE Price/Volume Stats

| Current price | $0.20 | 52-week high | $5.43 |

| Prev. close | $0.19 | 52-week low | $0.15 |

| Day low | $0.19 | Volume | 59,900 |

| Day high | $0.20 | Avg. volume | 190,976 |

| 50-day MA | $0.22 | Dividend yield | N/A |

| 200-day MA | $0.64 | Market Cap | 6.44M |

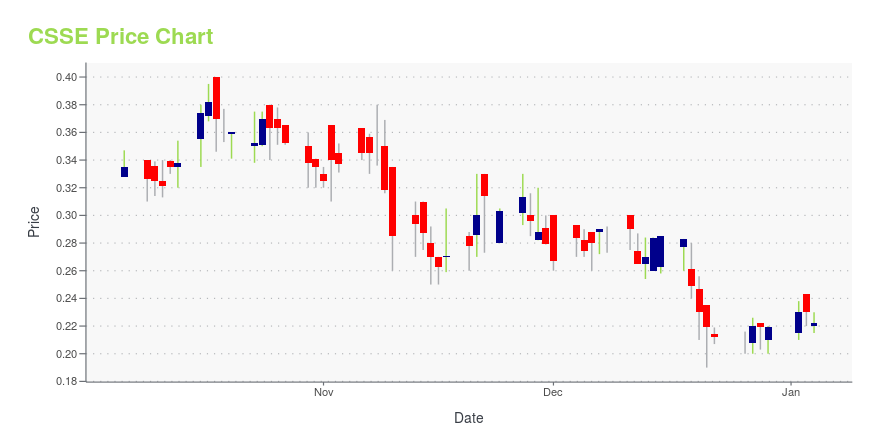

CSSE Stock Price Chart Interactive Chart >

CSSE POWR Grades

- CSSE scores best on the Value dimension, with a Value rank ahead of 36.61% of US stocks.

- CSSE's strongest trending metric is Sentiment; it's been moving down over the last 40 days.

- CSSE ranks lowest in Stability; there it ranks in the 2nd percentile.

CSSE Stock Summary

- With a price/sales ratio of 0.02, CHICKEN SOUP FOR THE SOUL ENTERTAINMENT INC has a higher such ratio than merely 0.22% of stocks in our set.

- Equity multiplier, or assets relative to shareholders' equity, comes in at -11.52 for CHICKEN SOUP FOR THE SOUL ENTERTAINMENT INC; that's greater than it is for only 2.23% of US stocks.

- Shareholder yield, a measure of how much is returned to shareholders via dividends and share repurchases, for CSSE comes in at -231.85% -- higher than that of just 2.01% of stocks in our set.

- Stocks with similar financial metrics, market capitalization, and price volatility to CHICKEN SOUP FOR THE SOUL ENTERTAINMENT INC are GREE, USAC, NEN, TLRY, and ARLP.

- CSSE's SEC filings can be seen here. And to visit CHICKEN SOUP FOR THE SOUL ENTERTAINMENT INC's official web site, go to www.cssentertainment.com.

CSSE Valuation Summary

- CSSE's price/sales ratio is 0; this is 100% lower than that of the median Communication Services stock.

- CSSE's EV/EBIT ratio has moved down 74.3 over the prior 77 months.

Below are key valuation metrics over time for CSSE.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| CSSE | 2023-12-29 | 0 | 0.0 | 0 | -1.1 |

| CSSE | 2023-12-28 | 0 | 0.0 | 0 | -1.1 |

| CSSE | 2023-12-27 | 0 | 0.0 | 0 | -1.1 |

| CSSE | 2023-12-26 | 0 | 0.0 | 0 | -1.1 |

| CSSE | 2023-12-22 | 0 | 0.0 | 0 | -1.1 |

| CSSE | 2023-12-21 | 0 | 0.4 | 0 | -3.6 |

CSSE's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- CSSE has a Quality Grade of D, ranking ahead of 24.05% of graded US stocks.

- CSSE's asset turnover comes in at 0.474 -- ranking 17th of 44 Entertainment stocks.

- RDI, WWE, and GAIA are the stocks whose asset turnover ratios are most correlated with CSSE.

The table below shows CSSE's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.474 | 0.282 | -0.433 |

| 2021-03-31 | 0.479 | 0.234 | -0.532 |

| 2020-12-31 | 0.422 | 0.214 | -0.599 |

| 2020-09-30 | 0.440 | 0.227 | -0.629 |

| 2020-09-30 | 0.440 | 0.227 | -0.629 |

| 2020-06-30 | 0.420 | 0.216 | -0.613 |

CSSE Price Target

For more insight on analysts targets of CSSE, see our CSSE price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $47.00 | Average Broker Recommendation | 1.35 (Strong Buy) |

Chicken Soup for the Soul Entertainment, Inc. - (CSSE) Company Bio

Chicken Soup for the Soul Entertainment, Inc. produces, distributes, and licenses video content-television programming, online video content, and motion pictures. It intends to provide its video content to consumers worldwide through television and online networks, including its online affiliate APlus.com. The company was founded in 2014 and is based in Cos Cob, Connecticut.

Latest CSSE News From Around the Web

Below are the latest news stories about CHICKEN SOUP FOR THE SOUL ENTERTAINMENT INC that investors may wish to consider to help them evaluate CSSE as an investment opportunity.

CSSE Stock Earnings: Chicken Soup for the Soul Misses EPS, Misses Revenue for Q3 2023CSSE stock results show that Chicken Soup for the Soul missed analyst estimates for earnings per share and missed on revenue for the third quarter of 2023. |

Chicken Soup for the Soul Entertainment, Inc. (CSSE) Reports Q3 Loss, Lags Revenue EstimatesChicken Soup for the Soul Entertainment, Inc. (CSSE) delivered earnings and revenue surprises of -1,038.84% and 34.92%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

Carnival (CCL) Reports Q4 Loss, Tops Revenue EstimatesCarnival (CCL) delivered earnings and revenue surprises of 41.67% and 1.50%, respectively, for the quarter ended November 2023. Do the numbers hold clues to what lies ahead for the stock? |

Chicken Soup for the Soul Entertainment Announces Timing of Regular Monthly Dividend for January for Series A Cumulative Redeemable Perpetual Preferred StockCOS COB, Conn., December 18, 2023--Chicken Soup for the Soul Entertainment Inc. (Nasdaq: CSSE, CSSEP, CSSEL, CSSEN), one of the largest providers of premium content to value-conscious consumers, today announced the timing for the payment of its declared regular monthly dividend of $0.2031 per share of its 9.75% Series A Cumulative Redeemable Perpetual Preferred Stock for January 2024. The dividend will be payable on or around January 15, 2024 to holders of record as of December 31, 2023. The div |

Loop Media (LPTV) Reports Q4 Loss, Lags Revenue EstimatesLoop Media (LPTV) delivered earnings and revenue surprises of -7.69% and 0.65%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

CSSE Price Returns

| 1-mo | 22.85% |

| 3-mo | -33.33% |

| 6-mo | -48.72% |

| 1-year | -96.23% |

| 3-year | -99.36% |

| 5-year | -97.37% |

| YTD | -8.84% |

| 2023 | -95.71% |

| 2022 | -63.01% |

| 2021 | -30.77% |

| 2020 | 149.88% |

| 2019 | 6.38% |

Continue Researching CSSE

Want to see what other sources are saying about Chicken Soup for the Soul Entertainment Inc's financials and stock price? Try the links below:Chicken Soup for the Soul Entertainment Inc (CSSE) Stock Price | Nasdaq

Chicken Soup for the Soul Entertainment Inc (CSSE) Stock Quote, History and News - Yahoo Finance

Chicken Soup for the Soul Entertainment Inc (CSSE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...