Gladstone Land Corporation (LAND): Price and Financial Metrics

LAND Price/Volume Stats

| Current price | $13.49 | 52-week high | $18.89 |

| Prev. close | $13.58 | 52-week low | $13.11 |

| Day low | $13.28 | Volume | 178,000 |

| Day high | $13.57 | Avg. volume | 220,367 |

| 50-day MA | $14.04 | Dividend yield | 4.14% |

| 200-day MA | $15.08 | Market Cap | 483.45M |

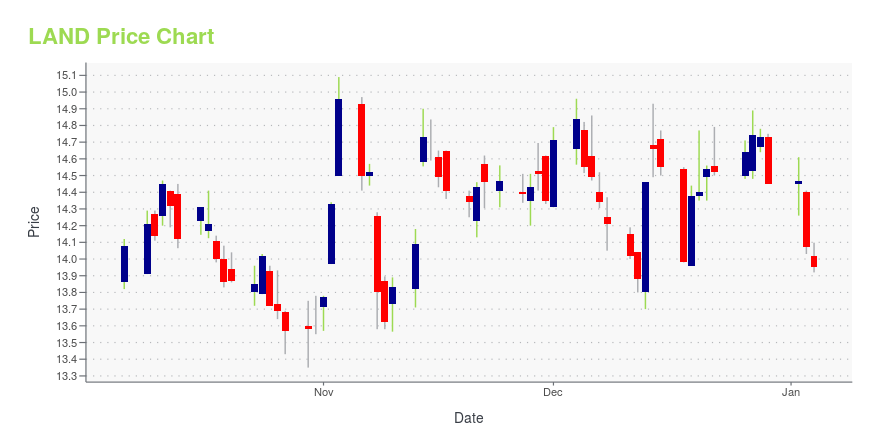

LAND Stock Price Chart Interactive Chart >

LAND POWR Grades

- LAND scores best on the Stability dimension, with a Stability rank ahead of 67.86% of US stocks.

- The strongest trend for LAND is in Value, which has been heading up over the past 26 weeks.

- LAND ranks lowest in Value; there it ranks in the 23rd percentile.

LAND Stock Summary

- The capital turnover (annual revenue relative to shareholder's equity) for LAND is 0.12 -- better than just 14.25% of US stocks.

- Of note is the ratio of GLADSTONE LAND CORP's sales and general administrative expense to its total operating expenses; only 4.07% of US stocks have a lower such ratio.

- The ratio of debt to operating expenses for GLADSTONE LAND CORP is higher than it is for about 94.81% of US stocks.

- Stocks that are quantitatively similar to LAND, based on their financial statements, market capitalization, and price volatility, are AQN, SVC, HPP, INN, and DHC.

- LAND's SEC filings can be seen here. And to visit GLADSTONE LAND CORP's official web site, go to www.gladstonefarms.com.

LAND Valuation Summary

- LAND's EV/EBIT ratio is 28.4; this is 4.05% lower than that of the median Real Estate stock.

- LAND's price/earnings ratio has moved down 213.3 over the prior 133 months.

Below are key valuation metrics over time for LAND.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| LAND | 2023-12-29 | 5.7 | 0.7 | -50.0 | 28.4 |

| LAND | 2023-12-28 | 5.8 | 0.7 | -50.9 | 28.6 |

| LAND | 2023-12-27 | 5.8 | 0.7 | -51.0 | 28.6 |

| LAND | 2023-12-26 | 5.8 | 0.7 | -50.6 | 28.5 |

| LAND | 2023-12-22 | 5.7 | 0.7 | -50.2 | 28.4 |

| LAND | 2023-12-21 | 5.7 | 0.7 | -50.3 | 28.4 |

LAND Growth Metrics

- Its year over year net cashflow from operations growth rate is now at 18.15%.

- Its 5 year revenue growth rate is now at 148.37%.

- Its 5 year price growth rate is now at 24.93%.

The table below shows LAND's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 87.245 | 35.094 | -11.648 |

| 2022-06-30 | 82.627 | 34.767 | -9.693 |

| 2022-03-31 | 79.227 | 33.274 | -9.289 |

| 2021-12-31 | 75.318 | 32.377 | -8.763 |

| 2021-09-30 | 67.642 | 33.765 | -9.734 |

| 2021-06-30 | 62.04 | 32.03 | -8.932 |

LAND's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- LAND has a Quality Grade of D, ranking ahead of 22.58% of graded US stocks.

- LAND's asset turnover comes in at 0.058 -- ranking 293rd of 442 Trading stocks.

- CUZ, RYN, and EQS are the stocks whose asset turnover ratios are most correlated with LAND.

The table below shows LAND's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.058 | 0.843 | 0.015 |

| 2021-03-31 | 0.059 | 0.840 | 0.016 |

| 2020-12-31 | 0.063 | 0.839 | 0.018 |

| 2020-09-30 | 0.065 | 0.836 | 0.020 |

| 2020-06-30 | 0.064 | 0.841 | 0.019 |

| 2020-03-31 | 0.063 | 0.832 | 0.019 |

LAND Price Target

For more insight on analysts targets of LAND, see our LAND price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $26.00 | Average Broker Recommendation | 1.71 (Moderate Buy) |

Gladstone Land Corporation (LAND) Company Bio

Gladstone Land Corporation, an externally-managed agricultural real estate investment trust, owns and leases farmland for independent and corporate farming operations in the United States. The company was founded in 1997 and is based in McLean, Virginia.

Latest LAND News From Around the Web

Below are the latest news stories about GLADSTONE LAND CORP that investors may wish to consider to help them evaluate LAND as an investment opportunity.

Gladstone Land Corporation (NASDAQ:LAND) Q3 2023 Earnings Call TranscriptGladstone Land Corporation (NASDAQ:LAND) Q3 2023 Earnings Call Transcript November 8, 2023 Operator: Greetings and welcome to the Gladstone Land Corporation Third Quarter Earnings Conference Call. [Operator Instructions] As a reminder, this conference is being recorded. It is now my pleasure to introduce your host, Mr. David Gladstone, Chief Executive Officer. Please proceed, sir. David […] |

Gladstone Land Announces Third Quarter 2023 ResultsPlease note that the limited information that follows in this press release is a summary and is not adequate for making an informed investment decision.MCLEAN, VA / ACCESSWIRE / November 7, 2023 / Gladstone Land Corporation (Nasdaq:LAND) ("Gladstone ... |

Gladstone Land Corporation Earnings Call and Webcast InformationMCLEAN, VA / ACCESSWIRE / November 6, 2023 / Gladstone Land Corporation (Nasdaq:LAND) announces the following event:What:Gladstone Land Corporation's Third Quarter Ended September 30, 2023, Earnings Call & WebcastWhen:Wednesday, November 8, 2023 @ ... |

Monthly Passive Income: 3 Growth Stocks Worth ConsideringConsider these three solid growth stocks for monthly passive income and enjoy steady dividends for years to come. |

Peapack-Gladstone (PGC) Misses Q3 Earnings EstimatesPeapack-Gladstone (PGC) delivered earnings and revenue surprises of -18.03% and 1.81%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

LAND Price Returns

| 1-mo | -0.68% |

| 3-mo | -5.90% |

| 6-mo | -13.72% |

| 1-year | -25.19% |

| 3-year | -19.59% |

| 5-year | 30.38% |

| YTD | -6.32% |

| 2023 | -18.50% |

| 2022 | -44.42% |

| 2021 | 136.25% |

| 2020 | 17.37% |

| 2019 | 17.65% |

LAND Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching LAND

Want to do more research on GLADSTONE LAND Corp's stock and its price? Try the links below:GLADSTONE LAND Corp (LAND) Stock Price | Nasdaq

GLADSTONE LAND Corp (LAND) Stock Quote, History and News - Yahoo Finance

GLADSTONE LAND Corp (LAND) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...