Lamar Advertising Co. (LAMR): Price and Financial Metrics

LAMR Price/Volume Stats

| Current price | $107.25 | 52-week high | $112.34 |

| Prev. close | $107.97 | 52-week low | $77.21 |

| Day low | $105.45 | Volume | 421,300 |

| Day high | $107.40 | Avg. volume | 362,524 |

| 50-day MA | $105.65 | Dividend yield | 4.66% |

| 200-day MA | $95.23 | Market Cap | 10.94B |

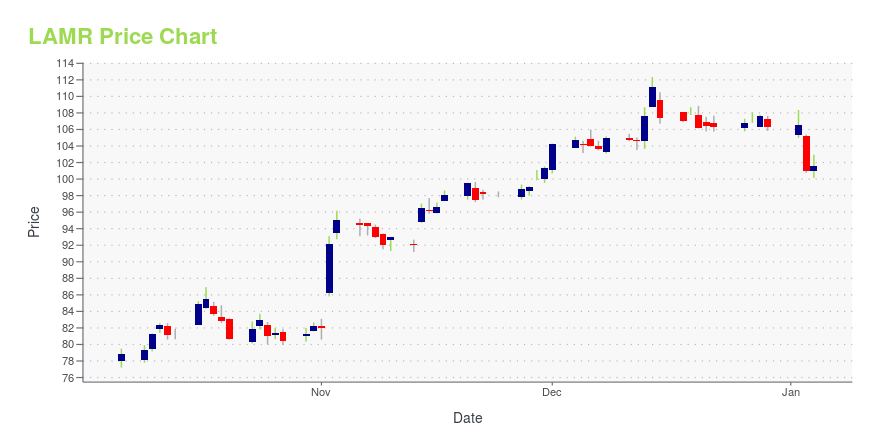

LAMR Stock Price Chart Interactive Chart >

LAMR POWR Grades

- Quality is the dimension where LAMR ranks best; there it ranks ahead of 83.45% of US stocks.

- The strongest trend for LAMR is in Stability, which has been heading down over the past 26 weeks.

- LAMR's current lowest rank is in the Sentiment metric (where it is better than 14.55% of US stocks).

LAMR Stock Summary

- LAMR has a higher market value than 83.07% of US stocks; more precisely, its current market capitalization is $10,304,874,206.

- The ratio of debt to operating expenses for LAMAR ADVERTISING CO is higher than it is for about 84.81% of US stocks.

- LAMR's equity multiplier -- a measure of assets relative to shareholders'equity -- is greater than that of 80.69% of US stocks.

- Stocks with similar financial metrics, market capitalization, and price volatility to LAMAR ADVERTISING CO are FWONA, NXST, MOS, NEWT, and SPH.

- LAMR's SEC filings can be seen here. And to visit LAMAR ADVERTISING CO's official web site, go to www.lamar.com.

LAMR Valuation Summary

- In comparison to the median Real Estate stock, LAMR's price/earnings ratio is 14.75% lower, now standing at 26.3.

- Over the past 243 months, LAMR's EV/EBIT ratio has gone down 347.3.

Below are key valuation metrics over time for LAMR.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| LAMR | 2023-12-29 | 5.2 | 9.1 | 26.3 | 25.9 |

| LAMR | 2023-12-28 | 5.3 | 9.2 | 26.6 | 26.1 |

| LAMR | 2023-12-27 | 5.2 | 9.2 | 26.5 | 26.0 |

| LAMR | 2023-12-26 | 5.2 | 9.2 | 26.4 | 26.0 |

| LAMR | 2023-12-22 | 5.2 | 9.1 | 26.3 | 25.9 |

| LAMR | 2023-12-21 | 5.2 | 9.1 | 26.3 | 25.9 |

LAMR Growth Metrics

- Its 3 year price growth rate is now at 33.29%.

- Its 4 year price growth rate is now at -9.34%.

- Its 5 year net cashflow from operations growth rate is now at 25.41%.

The table below shows LAMR's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 2,032.14 | 781.612 | 438.282 |

| 2022-09-30 | 1,991.204 | 783.288 | 495.493 |

| 2022-06-30 | 1,940.708 | 761.79 | 456.143 |

| 2022-03-31 | 1,867.908 | 753.137 | 441.547 |

| 2021-12-31 | 1,787.401 | 734.417 | 387.725 |

| 2021-09-30 | 1,721.352 | 696.65 | 373.117 |

LAMR's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- LAMR has a Quality Grade of B, ranking ahead of 88.56% of graded US stocks.

- LAMR's asset turnover comes in at 0.3 -- ranking 70th of 444 Trading stocks.

- SAMG, WHG, and SIEB are the stocks whose asset turnover ratios are most correlated with LAMR.

The table below shows LAMR's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.300 | 0.677 | 0.078 |

| 2021-06-30 | 0.284 | 0.665 | 0.072 |

| 2021-03-31 | 0.264 | 0.648 | 0.057 |

| 2020-12-31 | 0.262 | 0.645 | 0.057 |

| 2020-09-30 | 0.266 | 0.642 | 0.057 |

| 2020-06-30 | 0.276 | 0.650 | 0.063 |

LAMR Price Target

For more insight on analysts targets of LAMR, see our LAMR price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $88.67 | Average Broker Recommendation | 1.88 (Hold) |

Lamar Advertising Co. (LAMR) Company Bio

Lamar Advertising operates three types of outdoor advertising displays: billboards, logo signs and transit advertising displays. The company was founded in 1902 and is based in Baton Rouge, Louisiana.

Latest LAMR News From Around the Web

Below are the latest news stories about LAMAR ADVERTISING CO that investors may wish to consider to help them evaluate LAMR as an investment opportunity.

Lamar Advertising Co's Dividend AnalysisLamar Advertising Co (NASDAQ:LAMR) recently announced a dividend of $1.25 per share, payable on December 29, 2023, with the ex-dividend date set for December 15, 2023. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Lamar Advertising Co's dividend performance and assess its sustainability. |

3 Stocks in Focus on New Analyst CoverageThe recent surge in analyst coverage for stocks such as OFG, Lamar (LAMR) and Landsea (LSEA) indicates the potential for significant price appreciation in the near term. |

Is It Wise to Add Lamar (LAMR) Stock to Your Portfolio Now?Lamar (LAMR) holds a significant market share in the U.S. outdoor advertising business. Its diversified tenant base, opportunistic acquisitions and portfolio upgrade efforts are key growth drivers. |

Should You Hold Lamar Advertising Company (LAMR)?Artisan Partners, an investment management company, released its “Artisan Value Income Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. Us equities experienced a pullback in Q3 following the strong returns in the first half of 2023. The fund’s Investor Class APFWX, Advisor Class APDWX, and Institutional Class APHWX returned […] |

Lamar Advertising Company Announces Cash Dividend on Common StockBATON ROUGE, La., Nov. 29, 2023 (GLOBE NEWSWIRE) -- Lamar Advertising Company (Nasdaq: LAMR), a leading owner and operator of outdoor advertising and logo sign displays, announces that its board of directors has declared a quarterly cash dividend of $1.25 per share payable on December 29, 2023 to stockholders of record of Lamar’s Class A common stock and Class B common stock on December 18, 2023. Forward-Looking StatementsThis press release contains “forward-looking statements” concerning Lamar |

LAMR Price Returns

| 1-mo | 1.41% |

| 3-mo | 11.31% |

| 6-mo | 21.84% |

| 1-year | 4.84% |

| 3-year | 44.68% |

| 5-year | 73.10% |

| YTD | 0.91% |

| 2023 | 18.56% |

| 2022 | -18.04% |

| 2021 | 51.29% |

| 2020 | -3.19% |

| 2019 | 35.32% |

LAMR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching LAMR

Want to do more research on Lamar Advertising Co's stock and its price? Try the links below:Lamar Advertising Co (LAMR) Stock Price | Nasdaq

Lamar Advertising Co (LAMR) Stock Quote, History and News - Yahoo Finance

Lamar Advertising Co (LAMR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...