Lexington Realty Trust (LXP): Price and Financial Metrics

LXP Price/Volume Stats

| Current price | $8.63 | 52-week high | $11.38 |

| Prev. close | $8.75 | 52-week low | $7.75 |

| Day low | $8.58 | Volume | 2,895,700 |

| Day high | $8.84 | Avg. volume | 2,350,749 |

| 50-day MA | $9.39 | Dividend yield | 6.03% |

| 200-day MA | $9.43 | Market Cap | 2.53B |

LXP Stock Price Chart Interactive Chart >

LXP POWR Grades

- Stability is the dimension where LXP ranks best; there it ranks ahead of 63.56% of US stocks.

- LXP's strongest trending metric is Stability; it's been moving down over the last 26 weeks.

- LXP's current lowest rank is in the Value metric (where it is better than 9.7% of US stocks).

LXP Stock Summary

- LXP's current price/earnings ratio is 59.27, which is higher than 88.4% of US stocks with positive earnings.

- The ratio of debt to operating expenses for LXP INDUSTRIAL TRUST is higher than it is for about 97.84% of US stocks.

- LXP's price/sales ratio is 8.36; that's higher than the P/S ratio of 87.17% of US stocks.

- If you're looking for stocks that are quantitatively similar to LXP INDUSTRIAL TRUST, a group of peers worth examining would be PBA, HASI, MAA, HAL, and TRN.

- LXP's SEC filings can be seen here. And to visit LXP INDUSTRIAL TRUST's official web site, go to www.lxp.com.

LXP Valuation Summary

- LXP's price/sales ratio is 8.6; this is 79.17% higher than that of the median Real Estate stock.

- LXP's EV/EBIT ratio has moved up 23.2 over the prior 243 months.

Below are key valuation metrics over time for LXP.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| LXP | 2023-12-29 | 8.6 | 1.3 | 60.8 | 43.6 |

| LXP | 2023-12-28 | 8.7 | 1.3 | 61.7 | 44.0 |

| LXP | 2023-12-27 | 8.7 | 1.3 | 61.8 | 44.1 |

| LXP | 2023-12-26 | 8.6 | 1.3 | 61.3 | 43.8 |

| LXP | 2023-12-22 | 8.5 | 1.3 | 60.5 | 43.5 |

| LXP | 2023-12-21 | 8.4 | 1.3 | 59.6 | 43.0 |

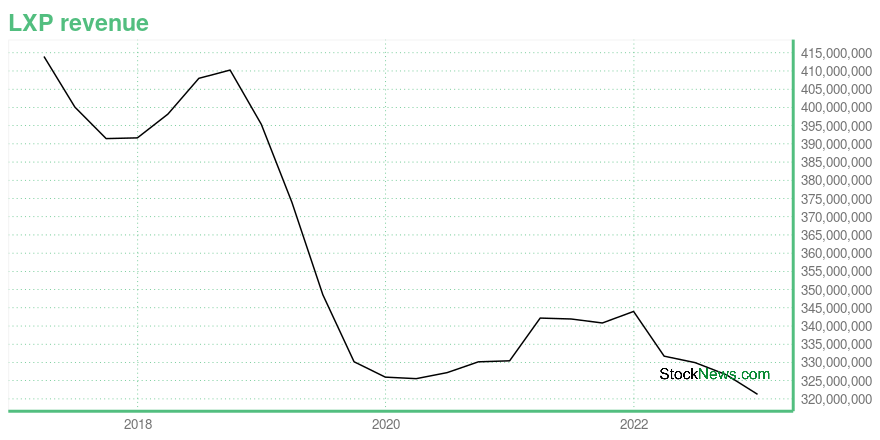

LXP Growth Metrics

- Its 4 year net income to common stockholders growth rate is now at 223.68%.

- The 3 year net cashflow from operations growth rate now stands at -2%.

- Its 4 year cash and equivalents growth rate is now at -62.61%.

The table below shows LXP's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 321.245 | 194.269 | 107.307 |

| 2022-09-30 | 326.623 | 207.054 | 330.81 |

| 2022-06-30 | 329.952 | 206.866 | 314.062 |

| 2022-03-31 | 331.718 | 205.036 | 345.395 |

| 2021-12-31 | 343.997 | 220.346 | 375.848 |

| 2021-09-30 | 340.83 | 216.774 | 218.129 |

LXP's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- LXP has a Quality Grade of C, ranking ahead of 69.84% of graded US stocks.

- LXP's asset turnover comes in at 0.095 -- ranking 222nd of 444 Trading stocks.

- JYNT, VNO, and HR are the stocks whose asset turnover ratios are most correlated with LXP.

The table below shows LXP's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.095 | 0.368 | 0.056 |

| 2021-06-30 | 0.096 | 0.385 | 0.065 |

| 2021-03-31 | 0.098 | 0.398 | 0.055 |

| 2020-12-31 | 0.096 | 0.384 | 0.051 |

| 2020-09-30 | 0.098 | 0.395 | 0.048 |

| 2020-06-30 | 0.101 | 0.402 | 0.073 |

LXP Price Target

For more insight on analysts targets of LXP, see our LXP price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $14.50 | Average Broker Recommendation | 1.7 (Moderate Buy) |

Lexington Realty Trust (LXP) Company Bio

Lexington Realty Trust owns a diversified portfolio of equity and debt interests in single-tenant commercial properties and land. The company was founded in 1991 and is based in New York City.

Latest LXP News From Around the Web

Below are the latest news stories about LXP INDUSTRIAL TRUST that investors may wish to consider to help them evaluate LXP as an investment opportunity.

LXP Industrial Trust Announces Pricing of Public Offering of $300 Million of Senior NotesNEW YORK, Nov. 02, 2023 (GLOBE NEWSWIRE) -- LXP Industrial Trust (NYSE: LXP) (“LXP”), a real estate investment trust (“REIT”) focused on single-tenant warehouse/distribution real estate investments, today announced that it has priced an underwritten public offering of $300 million aggregate principal amount of 6.750% senior unsecured notes due November 15, 2028 at a price equal to 99.423% of the principal amount, to yield 6.888%. Interest on the notes will be payable semi-annually commencing on |

LXP Industrial Trust Reports Q3 2023 Results: Net Income at $11.0 MillionIndustrial Same-Store NOI Increases by 5.0% Compared to Q3 2022 |

LXP Industrial Trust Reports Third Quarter 2023 ResultsBoard Authorizes 4% Dividend IncreaseNEW YORK, Oct. 31, 2023 (GLOBE NEWSWIRE) -- LXP Industrial Trust (“LXP”) (NYSE:LXP), a real estate investment trust focused on single-tenant warehouse/distribution real estate investments, today announced results for the quarter ended September 30, 2023. Third Quarter 2023 Highlights Recorded Net Income attributable to common shareholders of $11.0 million, or $0.04 per diluted common share.Generated Adjusted Company Funds From Operations available to all equi |

LXP Industrial Trust Publishes 2022 Corporate Responsibility Report and Announces 2023 GRESB® ResultsImproved 2023 GRESB® Overall Score Five Points and Maintained “A” for Public DisclosureNEW YORK, Oct. 26, 2023 (GLOBE NEWSWIRE) -- LXP Industrial Trust (NYSE:LXP) (“LXP”), a real estate investment trust (REIT) focused on single-tenant industrial real estate investments, today announced that it published its 2022 Corporate Responsibility Report. The report highlights LXP’s environmental, social, governance and resilience (ESG+R) initiatives, progress and accomplishments in 2022. LXP continues to |

LXP Industrial Trust to Report Third Quarter 2023 Results and Host Conference Call October 31, 2023NEW YORK, Oct. 09, 2023 (GLOBE NEWSWIRE) -- LXP Industrial Trust (NYSE:LXP) (“LXP”), a real estate investment trust (REIT) focused on single-tenant warehouse and distribution real estate investments, today announced it will release its third quarter 2023 financial results the morning of Tuesday, October 31, 2023. LXP will host its conference call and webcast that same day at 8:30 a.m., Eastern Time to discuss these results. Participants may access the call and webcast by the following: Conferenc |

LXP Price Returns

| 1-mo | -7.50% |

| 3-mo | 4.70% |

| 6-mo | -9.26% |

| 1-year | -18.66% |

| 3-year | -9.91% |

| 5-year | 12.31% |

| YTD | -13.00% |

| 2023 | 4.33% |

| 2022 | -32.96% |

| 2021 | 52.25% |

| 2020 | 4.19% |

| 2019 | 34.92% |

LXP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching LXP

Want to do more research on Lexington Realty Trust's stock and its price? Try the links below:Lexington Realty Trust (LXP) Stock Price | Nasdaq

Lexington Realty Trust (LXP) Stock Quote, History and News - Yahoo Finance

Lexington Realty Trust (LXP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...