One Liberty Properties, Inc. (OLP): Price and Financial Metrics

OLP Price/Volume Stats

| Current price | $20.54 | 52-week high | $23.86 |

| Prev. close | $20.69 | 52-week low | $17.55 |

| Day low | $20.20 | Volume | 44,200 |

| Day high | $20.79 | Avg. volume | 62,858 |

| 50-day MA | $21.46 | Dividend yield | 8.76% |

| 200-day MA | $20.23 | Market Cap | 432.70M |

OLP Stock Price Chart Interactive Chart >

OLP POWR Grades

- Sentiment is the dimension where OLP ranks best; there it ranks ahead of 84.65% of US stocks.

- The strongest trend for OLP is in Stability, which has been heading down over the past 26 weeks.

- OLP's current lowest rank is in the Growth metric (where it is better than 12.52% of US stocks).

OLP Stock Summary

- Of note is the ratio of ONE LIBERTY PROPERTIES INC's sales and general administrative expense to its total operating expenses; only 18.37% of US stocks have a lower such ratio.

- The ratio of debt to operating expenses for ONE LIBERTY PROPERTIES INC is higher than it is for about 92.4% of US stocks.

- The volatility of ONE LIBERTY PROPERTIES INC's share price is greater than that of merely 12.91% US stocks with at least 200 days of trading history.

- Stocks with similar financial metrics, market capitalization, and price volatility to ONE LIBERTY PROPERTIES INC are GTY, LPG, VCTR, EHC, and ARMK.

- Visit OLP's SEC page to see the company's official filings. To visit the company's web site, go to www.onelibertyproperties.com.

OLP Valuation Summary

- In comparison to the median Real Estate stock, OLP's price/sales ratio is 0% higher, now standing at 4.8.

- OLP's EV/EBIT ratio has moved up 1.3 over the prior 243 months.

Below are key valuation metrics over time for OLP.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| OLP | 2023-12-29 | 4.8 | 1.5 | 19.6 | 21.3 |

| OLP | 2023-12-28 | 4.9 | 1.6 | 20.0 | 21.5 |

| OLP | 2023-12-27 | 4.9 | 1.6 | 20.0 | 21.5 |

| OLP | 2023-12-26 | 5.0 | 1.6 | 20.1 | 21.6 |

| OLP | 2023-12-22 | 4.9 | 1.6 | 20.0 | 21.5 |

| OLP | 2023-12-21 | 4.8 | 1.5 | 19.7 | 21.3 |

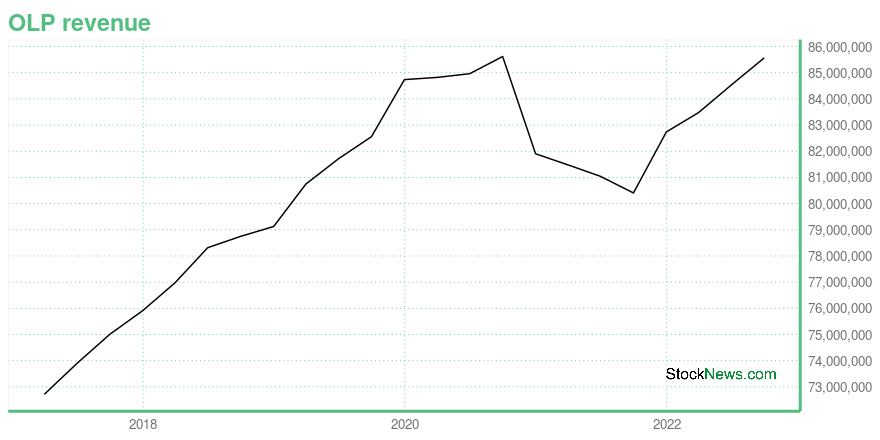

OLP Growth Metrics

- Its 5 year net income to common stockholders growth rate is now at -8.89%.

- Its 3 year revenue growth rate is now at 3.38%.

- Its 3 year net cashflow from operations growth rate is now at 12.54%.

The table below shows OLP's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 85.567 | 46.821 | 39.801 |

| 2022-06-30 | 84.53 | 45.229 | 38.656 |

| 2022-03-31 | 83.48 | 45.939 | 45.218 |

| 2021-12-31 | 82.74 | 48.561 | 38.857 |

| 2021-09-30 | 80.406 | 46.007 | 35.922 |

| 2021-06-30 | 81.041 | 44.128 | 43.588 |

OLP's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- OLP has a Quality Grade of B, ranking ahead of 80.17% of graded US stocks.

- OLP's asset turnover comes in at 0.105 -- ranking 200th of 444 Trading stocks.

- ARR, CUBE, and IVR are the stocks whose asset turnover ratios are most correlated with OLP.

The table below shows OLP's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.105 | 0.827 | 0.053 |

| 2021-03-31 | 0.104 | 0.828 | 0.034 |

| 2020-12-31 | 0.103 | 0.834 | 0.038 |

| 2020-09-30 | 0.108 | 0.841 | 0.039 |

| 2020-06-30 | 0.107 | 0.837 | 0.033 |

| 2020-03-31 | 0.107 | 0.834 | 0.034 |

OLP Price Target

For more insight on analysts targets of OLP, see our OLP price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $30.33 | Average Broker Recommendation | 1.83 (Hold) |

One Liberty Properties, Inc. (OLP) Company Bio

One Liberty Properties, Inc. engages in the acquisition, ownership, and management of commercial real estate properties in the United States. The company's property portfolio includes retail furniture stores, as well as industrial, office, flex, health and fitness, and other properties. The company was founded in 1982 and is based in Great Neck, New York.

Latest OLP News From Around the Web

Below are the latest news stories about ONE LIBERTY PROPERTIES INC that investors may wish to consider to help them evaluate OLP as an investment opportunity.

One Liberty (OLP) Completes Asset Sale Worth $63M in 2023One Liberty (OLP) carries out dispositions worth $63 million in 2023. Part of the proceeds was used to repay the outstanding balance on its credit facility. |

One Liberty Properties Raises $63 Million From Sale of 12 Assets in 2023– Closes On Six Previously Announced Asset Sales in Fourth Quarter –– Industrial Portfolio Expected to Represent 66% of 2024 Base Rent – GREAT NECK, N.Y., Dec. 21, 2023 (GLOBE NEWSWIRE) -- One Liberty Properties, Inc. (NYSE: OLP), an owner and manager of a geographically diversified portfolio consisting primarily of net-leased industrial properties, announced that it completed the sale of 12 assets for $63 million in 2023. During the fourth quarter, the Company closed on previously announced sal |

Should You Be Impressed By One Liberty Properties, Inc.'s (NYSE:OLP) ROE?While some investors are already well versed in financial metrics (hat tip), this article is for those who would like... |

One Liberty Properties Announces 124th Consecutive Quarterly Dividend– Increased or Maintained Dividend for Over 30 Consecutive Years – – Increases Current Share Repurchase Authorization – GREAT NECK, N.Y., Dec. 05, 2023 (GLOBE NEWSWIRE) -- One Liberty Properties, Inc. (NYSE: OLP) today announced that its Board of Directors declared a quarterly dividend on the Company’s common stock of $0.45 per share. The dividend is payable on January 5, 2024 to stockholders of record at the close of business on December 20, 2023, and represents One Liberty’s 124th consecutive |

One Liberty Properties Announces Asset Sales for $32 Million– Closes Sales of Three Properties –– Agrees to Sell Five Additional Assets –– Refinances Two Industrial Properties – GREAT NECK, N.Y., Nov. 30, 2023 (GLOBE NEWSWIRE) -- One Liberty Properties, Inc. (NYSE: OLP), an owner and manager of a geographically diversified portfolio consisting primarily of industrial properties, announced that it completed the sale of two restaurant properties and a portion of a retail property for a an aggregate sales price of approximately $8.7 million. The Company ant |

OLP Price Returns

| 1-mo | -3.11% |

| 3-mo | 6.49% |

| 6-mo | 9.54% |

| 1-year | -5.58% |

| 3-year | 21.24% |

| 5-year | 5.89% |

| YTD | -6.25% |

| 2023 | 7.57% |

| 2022 | -32.34% |

| 2021 | 87.10% |

| 2020 | -18.50% |

| 2019 | 19.44% |

OLP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching OLP

Want to see what other sources are saying about One Liberty Properties Inc's financials and stock price? Try the links below:One Liberty Properties Inc (OLP) Stock Price | Nasdaq

One Liberty Properties Inc (OLP) Stock Quote, History and News - Yahoo Finance

One Liberty Properties Inc (OLP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...