Weyerhaeuser Co. (WY): Price and Financial Metrics

WY Price/Volume Stats

| Current price | $32.99 | 52-week high | $35.14 |

| Prev. close | $33.42 | 52-week low | $27.65 |

| Day low | $32.87 | Volume | 3,199,400 |

| Day high | $33.29 | Avg. volume | 3,557,636 |

| 50-day MA | $33.23 | Dividend yield | 2.3% |

| 200-day MA | $31.80 | Market Cap | 24.08B |

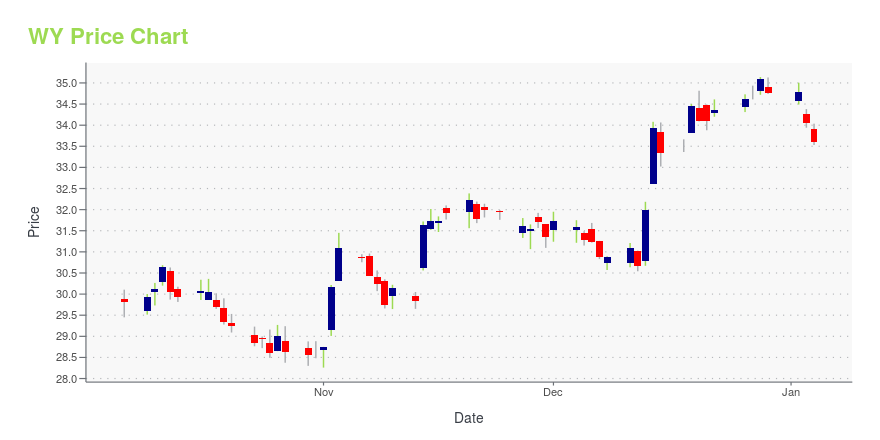

WY Stock Price Chart Interactive Chart >

WY POWR Grades

- WY scores best on the Growth dimension, with a Growth rank ahead of 68.45% of US stocks.

- WY's strongest trending metric is Growth; it's been moving up over the last 26 weeks.

- WY's current lowest rank is in the Sentiment metric (where it is better than 33.44% of US stocks).

WY Stock Summary

- WEYERHAEUSER CO's stock had its IPO on January 1, 1986, making it an older stock than 92.92% of US equities in our set.

- For WY, its debt to operating expenses ratio is greater than that reported by 93.02% of US equities we're observing.

- The volatility of WEYERHAEUSER CO's share price is greater than that of merely 9.29% US stocks with at least 200 days of trading history.

- Stocks with similar financial metrics, market capitalization, and price volatility to WEYERHAEUSER CO are MLM, VMC, YUM, CACC, and CLF.

- Visit WY's SEC page to see the company's official filings. To visit the company's web site, go to www.weyerhaeuser.com.

WY Valuation Summary

- In comparison to the median Real Estate stock, WY's price/sales ratio is 31.25% lower, now standing at 3.3.

- Over the past 243 months, WY's price/sales ratio has gone up 2.6.

Below are key valuation metrics over time for WY.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| WY | 2023-12-29 | 3.3 | 2.5 | 40.2 | 31.1 |

| WY | 2023-12-28 | 3.3 | 2.5 | 40.6 | 31.4 |

| WY | 2023-12-27 | 3.3 | 2.5 | 40.2 | 31.1 |

| WY | 2023-12-26 | 3.3 | 2.5 | 40.1 | 31.0 |

| WY | 2023-12-22 | 3.2 | 2.5 | 39.8 | 30.8 |

| WY | 2023-12-21 | 3.2 | 2.4 | 39.5 | 30.6 |

WY Growth Metrics

- Its 2 year price growth rate is now at 129.38%.

- Its 3 year cash and equivalents growth rate is now at 365.25%.

- Its 2 year revenue growth rate is now at 62.78%.

The table below shows WY's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 10,184 | 2,832 | 1,880 |

| 2022-09-30 | 10,567 | 3,159 | 2,285 |

| 2022-06-30 | 10,636 | 3,256 | 2,457 |

| 2022-03-31 | 10,807 | 3,418 | 2,697 |

| 2021-12-31 | 10,201 | 3,159 | 2,607 |

| 2021-09-30 | 10,058 | 3,109 | 2,483 |

WY's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- WY has a Quality Grade of B, ranking ahead of 75.72% of graded US stocks.

- WY's asset turnover comes in at 0.582 -- ranking 34th of 443 Trading stocks.

- JHG, AVB, and GROW are the stocks whose asset turnover ratios are most correlated with WY.

The table below shows WY's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.582 | 0.401 | 0.173 |

| 2021-06-30 | 0.583 | 0.396 | 0.164 |

| 2021-03-31 | 0.505 | 0.324 | 0.104 |

| 2020-12-31 | 0.455 | 0.259 | 0.068 |

| 2020-09-30 | 0.424 | 0.227 | 0.049 |

| 2020-06-30 | 0.394 | 0.183 | 0.034 |

WY Price Target

For more insight on analysts targets of WY, see our WY price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $40.50 | Average Broker Recommendation | 1.4 (Strong Buy) |

Weyerhaeuser Co. (WY) Company Bio

Weyerhaeuser Company (/ˈwɛərhaʊzər/) is an American timberland company which owns nearly 12,400,000 acres (19,400 sq mi; 50,000 km2) of timberlands in the U.S., and manages an additional 14,000,000 acres (22,000 sq mi; 57,000 km2) of timberlands under long-term licenses in Canada.[3] The company also manufactures wood products.[4] It operates as a real estate investment trust. (Source:Wikipedia)

Latest WY News From Around the Web

Below are the latest news stories about WEYERHAEUSER CO that investors may wish to consider to help them evaluate WY as an investment opportunity.

Weyerhaeuser Sells Its First Carbon OffsetsWeyerhaeuser, America's largest private landowner, said it has sold its first batch of carbon offsets, marking the forest-products giant's entry into [the booming market for standing trees](https://www. |

Weyerhaeuser Completes Sale of Initial Carbon Credit OfferingWeyerhaeuser Company (NYSE: WY) today announced an agreement for the sale of nearly 32,000 forest carbon credits at $29 per credit. This agreement marks Weyerhaeuser's first transaction in the voluntary carbon market and represents the sale of all credits issued by ACR for the first year of the company's Kibby Skinner Improved Forest Management (IFM) Project in Maine. Weyerhaeuser will immediately retire these credits on behalf of the buyer. |

Weyerhaeuser Co President and CEO Devin Stockfish Sells 29,008 SharesOn December 20, 2023, Devin Stockfish, President and CEO of Weyerhaeuser Co (NYSE:WY), sold 29,008 shares of the company according to a recent SEC Filing. |

Weyerhaeuser to Release Fourth Quarter Results on January 25Weyerhaeuser Company (NYSE: WY) will release fourth quarter 2023 results on Thursday, January 25, after the market closes. The company will then hold a live webcast and conference call the following day, on Friday, January 26, at 7 a.m. Pacific (10 a.m. Eastern), to discuss the results. |

5 Market-Beating Construction Picks That Might Lose Steam in 2024Despite reducing inflationary pressure and stable interest rates, a few stocks in the construction sector are likely to perform tepidly in 2024. Let's check what is hurting WY, PCH, CHX, MTZ and HLMN. |

WY Price Returns

| 1-mo | 0.85% |

| 3-mo | 4.88% |

| 6-mo | 0.61% |

| 1-year | 5.43% |

| 3-year | 8.84% |

| 5-year | 57.92% |

| YTD | -4.72% |

| 2023 | 18.04% |

| 2022 | -20.44% |

| 2021 | 26.92% |

| 2020 | 13.04% |

| 2019 | 45.57% |

WY Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching WY

Want to do more research on Weyerhaeuser Co's stock and its price? Try the links below:Weyerhaeuser Co (WY) Stock Price | Nasdaq

Weyerhaeuser Co (WY) Stock Quote, History and News - Yahoo Finance

Weyerhaeuser Co (WY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...