Hannon Armstrong Sustainable Infrastructure Capital, Inc. (HASI): Price and Financial Metrics

HASI Price/Volume Stats

| Current price | $26.24 | 52-week high | $36.44 |

| Prev. close | $25.52 | 52-week low | $13.22 |

| Day low | $25.52 | Volume | 1,650,800 |

| Day high | $26.93 | Avg. volume | 1,168,209 |

| 50-day MA | $25.37 | Dividend yield | 6.02% |

| 200-day MA | $23.63 | Market Cap | 2.92B |

HASI Stock Price Chart Interactive Chart >

HASI POWR Grades

- Growth is the dimension where HASI ranks best; there it ranks ahead of 86.38% of US stocks.

- The strongest trend for HASI is in Stability, which has been heading down over the past 26 weeks.

- HASI ranks lowest in Value; there it ranks in the 9th percentile.

HASI Stock Summary

- The price/operating cash flow metric for HANNON ARMSTRONG SUSTAINABLE INFRASTRUCTURE CAPITAL INC is higher than 97.18% of stocks in our set with a positive cash flow.

- The ratio of debt to operating expenses for HANNON ARMSTRONG SUSTAINABLE INFRASTRUCTURE CAPITAL INC is higher than it is for about 97.64% of US stocks.

- Shareholder yield, a measure of how much is returned to shareholders via dividends and share repurchases, for HASI comes in at -51.7% -- higher than that of just 7.77% of stocks in our set.

- Stocks with similar financial metrics, market capitalization, and price volatility to HANNON ARMSTRONG SUSTAINABLE INFRASTRUCTURE CAPITAL INC are LXP, WSR, MAA, TRN, and VIRT.

- HASI's SEC filings can be seen here. And to visit HANNON ARMSTRONG SUSTAINABLE INFRASTRUCTURE CAPITAL INC's official web site, go to www.hannonarmstrong.com.

HASI Valuation Summary

- In comparison to the median Real Estate stock, HASI's price/earnings ratio is 154.13% higher, now standing at 78.4.

- HASI's price/earnings ratio has moved up 33.1 over the prior 130 months.

Below are key valuation metrics over time for HASI.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| HASI | 2023-12-29 | 10.5 | 1.5 | 78.4 | 36.8 |

| HASI | 2023-12-28 | 10.7 | 1.5 | 80.0 | 37.2 |

| HASI | 2023-12-27 | 10.8 | 1.5 | 80.8 | 37.4 |

| HASI | 2023-12-26 | 10.8 | 1.5 | 80.5 | 37.3 |

| HASI | 2023-12-22 | 10.6 | 1.5 | 79.2 | 37.0 |

| HASI | 2023-12-21 | 10.6 | 1.5 | 78.9 | 36.9 |

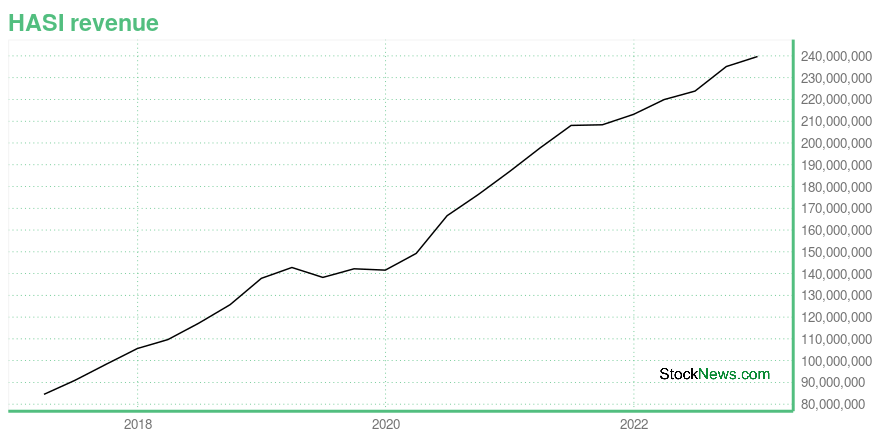

HASI Growth Metrics

- Its 5 year cash and equivalents growth rate is now at 959.49%.

- Its 5 year revenue growth rate is now at 76.62%.

- Its 4 year net income to common stockholders growth rate is now at 393.64%.

The table below shows HASI's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 239.737 | 0.23 | 41.502 |

| 2022-09-30 | 235.125 | 55.598 | 123.851 |

| 2022-06-30 | 223.857 | -11.388 | 86.479 |

| 2022-03-31 | 219.948 | -0.455 | 120.902 |

| 2021-12-31 | 213.166 | 13.309 | 126.579 |

| 2021-09-30 | 208.36 | 43.106 | 89.085 |

HASI's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- HASI has a Quality Grade of C, ranking ahead of 57.38% of graded US stocks.

- HASI's asset turnover comes in at 0.059 -- ranking 293rd of 444 Trading stocks.

- BCSF, WETF, and COR are the stocks whose asset turnover ratios are most correlated with HASI.

The table below shows HASI's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.059 | 1 | 0.046 |

| 2021-03-31 | 0.061 | 1 | 0.044 |

| 2020-12-31 | 0.061 | 1 | 0.039 |

| 2020-09-30 | 0.064 | 1 | 0.049 |

| 2020-06-30 | 0.066 | 1 | 0.047 |

| 2020-03-31 | 0.065 | 1 | 0.049 |

Hannon Armstrong Sustainable Infrastructure Capital, Inc. (HASI) Company Bio

Hannon Armstrong Sustainable Infrastructure Capital provides debt and equity financing to the energy efficiency and renewable energy markets in the United States. The company was founded in 2012 and is based in Annapolis, Maryland.

Latest HASI News From Around the Web

Below are the latest news stories about HANNON ARMSTRONG SUSTAINABLE INFRASTRUCTURE CAPITAL INC that investors may wish to consider to help them evaluate HASI as an investment opportunity.

HASI Announces Conversion to C-CorporationANNAPOLIS, Md., December 21, 2023--Hannon Armstrong Sustainable Infrastructure Capital, Inc. ("HASI," "We," "Our" or the "Company") (NYSE: HASI), a leading investor in climate solutions, today announced that its Board of Directors (the "Board") has unanimously approved a plan to revoke its Real Estate Investment Trust (REIT) election and become a taxable C-Corporation, effective January 1, 2024. |

Looking for a Growth Stock? 3 Reasons Why Hannon Armstrong (HASI) is a Solid ChoiceHannon Armstrong (HASI) is well positioned to outperform the market, as it exhibits above-average growth in financials. |

Hannon Armstrong files to sell common stock for holdersMore on Hannon Armstrong... |

HASI Upsizes and Prices Private Offering of $550 Million of Green Senior Unsecured Notes to Invest in Near-Term Opportunities at Attractive YieldsANNAPOLIS, Md., December 05, 2023--Hannon Armstrong Sustainable Infrastructure Capital, Inc. ("HASI," "our," or the "Company") (NYSE: HASI), a leading investor in climate solutions, today announced that it has upsized and priced its private offering of $550 million in aggregate principal amount of 8% green senior unsecured notes due 2027 (the "Notes") by its indirect subsidiaries, HAT Holdings I LLC ("HAT I") and HAT Holdings II LLC ("HAT II," and together with HAT I, the "Issuers"). At issuance |

HASI Announces Proposed Private Offering of $500 Million Green Senior Unsecured Notes to Invest in Near-Term Opportunities at Attractive YieldsANNAPOLIS, Md., December 04, 2023--Hannon Armstrong Sustainable Infrastructure Capital, Inc. ("HASI," "our," or the "Company") (NYSE: HASI), a leading investor in climate solutions, today announced, subject to market conditions, a private offering of $500 million in aggregate principal amount of green senior unsecured notes due 2027 (the "Notes") by its indirect subsidiaries, HAT Holdings I LLC ("HAT I") and HAT Holdings II LLC ("HAT II," and together with HAT I, the "Issuers"). At issuance, the |

HASI Price Returns

| 1-mo | 16.93% |

| 3-mo | 11.85% |

| 6-mo | 28.88% |

| 1-year | -18.18% |

| 3-year | -51.68% |

| 5-year | 39.19% |

| YTD | -4.86% |

| 2023 | 1.49% |

| 2022 | -43.05% |

| 2021 | -14.08% |

| 2020 | 105.59% |

| 2019 | 77.07% |

HASI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HASI

Want to see what other sources are saying about Hannon Armstrong Sustainable Infrastructure Capital Inc's financials and stock price? Try the links below:Hannon Armstrong Sustainable Infrastructure Capital Inc (HASI) Stock Price | Nasdaq

Hannon Armstrong Sustainable Infrastructure Capital Inc (HASI) Stock Quote, History and News - Yahoo Finance

Hannon Armstrong Sustainable Infrastructure Capital Inc (HASI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...