AES Corp. (AES): Price and Financial Metrics

AES Price/Volume Stats

| Current price | $16.77 | 52-week high | $26.41 |

| Prev. close | $16.78 | 52-week low | $11.43 |

| Day low | $16.41 | Volume | 5,774,000 |

| Day high | $16.85 | Avg. volume | 6,097,667 |

| 50-day MA | $17.87 | Dividend yield | 4.11% |

| 200-day MA | $18.28 | Market Cap | 11.23B |

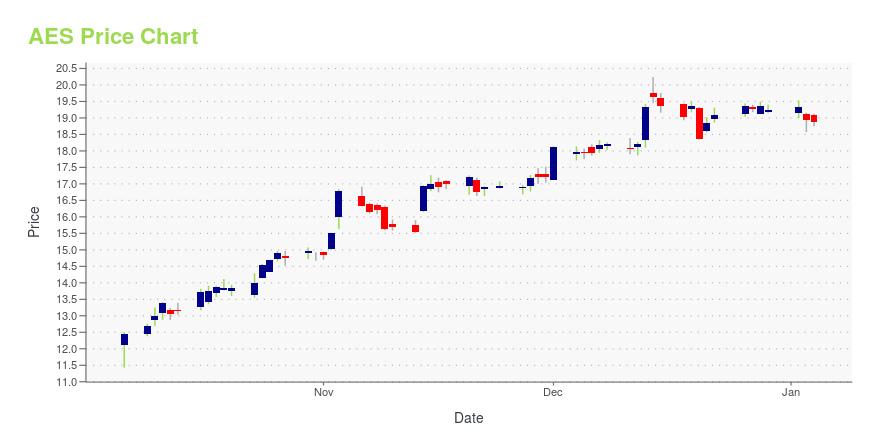

AES Stock Price Chart Interactive Chart >

AES POWR Grades

- AES scores best on the Growth dimension, with a Growth rank ahead of 54.16% of US stocks.

- AES's strongest trending metric is Stability; it's been moving down over the last 26 weeks.

- AES's current lowest rank is in the Quality metric (where it is better than 5.53% of US stocks).

AES Stock Summary

- Of note is the ratio of AES CORP's sales and general administrative expense to its total operating expenses; only 5.06% of US stocks have a lower such ratio.

- For AES, its debt to operating expenses ratio is greater than that reported by 96.03% of US equities we're observing.

- Equity multiplier, or assets relative to shareholders' equity, comes in at 16.13 for AES CORP; that's greater than it is for 96.82% of US stocks.

- Stocks that are quantitatively similar to AES, based on their financial statements, market capitalization, and price volatility, are GEL, GTN, SOHO, AL, and AQN.

- AES's SEC filings can be seen here. And to visit AES CORP's official web site, go to www.aes.com.

AES Valuation Summary

- AES's price/sales ratio is 1; this is 54.55% lower than that of the median Utilities stock.

- Over the past 243 months, AES's price/sales ratio has gone up 0.3.

Below are key valuation metrics over time for AES.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| AES | 2023-12-27 | 1 | 4.6 | -23.1 | 39.4 |

| AES | 2023-12-26 | 1 | 4.7 | -23.1 | 39.5 |

| AES | 2023-12-22 | 1 | 4.6 | -22.8 | 39.3 |

| AES | 2023-12-21 | 1 | 4.5 | -22.5 | 39.1 |

| AES | 2023-12-20 | 1 | 4.4 | -22.0 | 38.8 |

| AES | 2023-12-19 | 1 | 4.7 | -23.1 | 39.5 |

AES Growth Metrics

- Its year over year net cashflow from operations growth rate is now at -20.08%.

- Its 2 year cash and equivalents growth rate is now at -29.44%.

- The 3 year price growth rate now stands at 29.04%.

The table below shows AES's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 12,327 | 2,172 | -275 |

| 2022-06-30 | 11,736 | 2,163 | -353 |

| 2022-03-31 | 11,358 | 2,106 | -146 |

| 2021-12-31 | 11,141 | 1,902 | -409 |

| 2021-09-30 | 10,931 | 2,047 | 541 |

| 2021-06-30 | 10,440 | 2,539 | -135 |

AES's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- AES has a Quality Grade of D, ranking ahead of 24.86% of graded US stocks.

- AES's asset turnover comes in at 0.301 -- ranking 14th of 14 Almost Nothing stocks.

- CVA, PESI, and SRCL are the stocks whose asset turnover ratios are most correlated with AES.

The table below shows AES's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.301 | 0.293 | 0.018 |

| 2021-03-31 | 0.287 | 0.286 | 0.019 |

| 2020-12-31 | 0.281 | 0.279 | 0.028 |

| 2020-09-30 | 0.279 | 0.246 | 0.016 |

| 2020-06-30 | 0.283 | 0.238 | 0.033 |

| 2020-03-31 | 0.294 | 0.230 | 0.036 |

AES Price Target

For more insight on analysts targets of AES, see our AES price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $30.06 | Average Broker Recommendation | 1.35 (Strong Buy) |

AES Corp. (AES) Company Bio

The AES Corporation is an American utility and power generation company. It owns and operates power plants, which it uses to generate and sell electricity to end users and intermediaries like utilities and industrial facilities. AES is headquartered in Arlington, Virginia, and is one of the world's leading power companies, generating and distributing electric power in 15 countries and employing 10,500 people worldwide. AES Corporation is a global Fortune 500 power company. AES Ranks in the Top Ten of Fast Company's 2022 Best Workplaces for Innovators. (Source:Wikipedia)

Latest AES News From Around the Web

Below are the latest news stories about AES CORP that investors may wish to consider to help them evaluate AES as an investment opportunity.

American Electric Power (AEP) to Sell Stake in New Mexico AssetAmerican Electric Power (AEP) continues to streamline its operation by divesting non-core assets and adding more renewable assets to its generation portfolio. |

AES Announces Closing of Previously Announced and New Minority Sell-Downs of LNG Businesses in the Dominican Republic and PanamaThe AES Corporation (NYSE: AES) announced today that it has closed minority sell-downs of its businesses in the Dominican Republic and its AES Colón business in Panama for proceeds of $338 million. This includes the transactions announced in September for proceeds of $179 million after purchase price adjustments at closing, as well as sell-downs of additional stakes in the businesses through the expansion of existing partnerships with Grupo Estrella and Grupo Popular's subsidiary, AFI Popular, t |

Company News for Dec 19, 2023Companies in The News Are: AAPL, PLD, X, AES |

Today's Big Winners: Real-Estate and Utility StocksReal-estate and utility stocks jumped to one of their best days of the year following [the Fed's decision](https://www.wsj.com/economy/central-banking/fed-holds-rates-steady-and-sees-cuts-next-year-4d554e9f) to hold borrowing costs steady and the central bank's opening the door to interest-rate cuts next year. |

AES' Board Rewards Shareholders With 4% Dividend HikeAES continues to reward shareholders through dividend hikes. It has been paying dividends for 11 consecutive years. |

AES Price Returns

| 1-mo | 0.31% |

| 3-mo | 1.21% |

| 6-mo | -6.49% |

| 1-year | -33.72% |

| 3-year | -35.33% |

| 5-year | 13.84% |

| YTD | -11.99% |

| 2023 | -30.88% |

| 2022 | 21.69% |

| 2021 | 5.93% |

| 2020 | 22.15% |

| 2019 | 42.16% |

AES Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching AES

Want to see what other sources are saying about Aes Corp's financials and stock price? Try the links below:Aes Corp (AES) Stock Price | Nasdaq

Aes Corp (AES) Stock Quote, History and News - Yahoo Finance

Aes Corp (AES) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...