IDACORP, Inc. (IDA): Price and Financial Metrics

IDA Price/Volume Stats

| Current price | $88.67 | 52-week high | $112.96 |

| Prev. close | $88.93 | 52-week low | $86.43 |

| Day low | $87.74 | Volume | 344,500 |

| Day high | $89.25 | Avg. volume | 321,961 |

| 50-day MA | $94.94 | Dividend yield | 3.74% |

| 200-day MA | $98.63 | Market Cap | 4.49B |

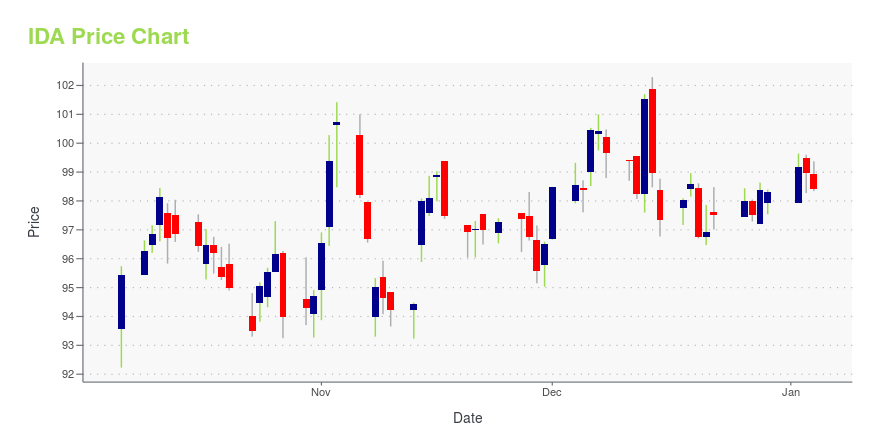

IDA Stock Price Chart Interactive Chart >

IDA POWR Grades

- Sentiment is the dimension where IDA ranks best; there it ranks ahead of 67.3% of US stocks.

- IDA's strongest trending metric is Stability; it's been moving down over the last 26 weeks.

- IDA's current lowest rank is in the Value metric (where it is better than 11.12% of US stocks).

IDA Stock Summary

- IDACORP INC's stock had its IPO on October 17, 1986, making it an older stock than 92.3% of US equities in our set.

- Of note is the ratio of IDACORP INC's sales and general administrative expense to its total operating expenses; only 0.17% of US stocks have a lower such ratio.

- For IDA, its debt to operating expenses ratio is greater than that reported by 92.87% of US equities we're observing.

- If you're looking for stocks that are quantitatively similar to IDACORP INC, a group of peers worth examining would be NWN, LNT, MGEE, AGR, and UTL.

- Visit IDA's SEC page to see the company's official filings. To visit the company's web site, go to www.idacorpinc.com.

IDA Valuation Summary

- In comparison to the median Utilities stock, IDA's price/sales ratio is 27.27% higher, now standing at 2.8.

- Over the past 243 months, IDA's price/earnings ratio has gone down 10.8.

Below are key valuation metrics over time for IDA.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| IDA | 2023-12-27 | 2.8 | 1.7 | 18.1 | 16.9 |

| IDA | 2023-12-26 | 2.8 | 1.7 | 18.2 | 16.9 |

| IDA | 2023-12-22 | 2.8 | 1.7 | 18.1 | 16.9 |

| IDA | 2023-12-21 | 2.8 | 1.7 | 18.0 | 16.8 |

| IDA | 2023-12-20 | 2.8 | 1.7 | 18.0 | 16.8 |

| IDA | 2023-12-19 | 2.8 | 1.7 | 18.3 | 17.0 |

IDA Growth Metrics

- The year over year price growth rate now stands at 4.84%.

- Its 4 year cash and equivalents growth rate is now at 195.41%.

- Its 2 year price growth rate is now at 15.73%.

The table below shows IDA's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 1,643.981 | 351.285 | 258.982 |

| 2022-09-30 | 1,556.035 | 328.832 | 249.725 |

| 2022-06-30 | 1,484.967 | 352.024 | 241.242 |

| 2022-03-31 | 1,486.318 | 372.601 | 246.978 |

| 2021-12-31 | 1,458.084 | 363.264 | 245.55 |

| 2021-09-30 | 1,438.766 | 407.508 | 250.258 |

IDA's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- IDA has a Quality Grade of C, ranking ahead of 63.15% of graded US stocks.

- IDA's asset turnover comes in at 0.201 -- ranking 63rd of 105 Utilities stocks.

- DTE, CPK, and OKE are the stocks whose asset turnover ratios are most correlated with IDA.

The table below shows IDA's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.201 | 0.419 | 0.045 |

| 2021-06-30 | 0.200 | 0.422 | 0.046 |

| 2021-03-31 | 0.196 | 0.422 | 0.044 |

| 2020-12-31 | 0.195 | 0.416 | 0.044 |

| 2020-09-30 | 0.195 | 0.398 | 0.045 |

| 2020-06-30 | 0.193 | 0.400 | 0.044 |

IDA Price Target

For more insight on analysts targets of IDA, see our IDA price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $113.50 | Average Broker Recommendation | 1.62 (Moderate Buy) |

IDACORP, Inc. (IDA) Company Bio

IdaCorp Inc. engages in the generation, transmission, distribution, purchase, and sale of electric energy in the United States. The company was founded in 1915 and is based in Boise, Idaho.

Latest IDA News From Around the Web

Below are the latest news stories about IDACORP INC that investors may wish to consider to help them evaluate IDA as an investment opportunity.

VST or IDA: Which is a Better Utility Electric Power Stock?Both Vistra (VST) and IDACORP (IDA) work efficiently and continue to provide reliable service to their customers. |

What IDACORP, Inc.'s (NYSE:IDA) P/E Is Not Telling YouWith a median price-to-earnings (or "P/E") ratio of close to 17x in the United States, you could be forgiven for... |

IDACORP and Idaho Power Announce New Vice PresidentBOISE, Idaho, December 15, 2023--IDACORP, Inc. (NYSE:IDA): IDACORP, Inc. and Idaho Power announced today that Amy Shaw has been named Vice President of Finance, Compliance, and Risk, effective January 1. Shaw currently serves as the Director of Investor Relations, Compliance, and Risk for IDACORP and Idaho Power. |

Reasons to Add IDACORP (IDA) to Your Portfolio Right NowIDACORP (IDA) makes a strong case for investment, given its earnings growth prospects, strong ROE and ability to increase shareholders' value. |

IDACORP, Inc. Prices Public Offering of 2,801,724 Shares of Common StockBOISE, Idaho, November 08, 2023--IDACORP, Inc. (NYSE: IDA) announced today that it has priced an underwritten public offering of 2,801,724 shares of its common stock at a public offering price of $92.80 per share. Subject to certain conditions, all shares are expected to be borrowed by the forward counterparty (as defined below) (or its affiliates) and sold to the underwriters in the offering in connection with the forward sale agreement described below. In conjunction with the offering, IDACORP |

IDA Price Returns

| 1-mo | -3.29% |

| 3-mo | -7.81% |

| 6-mo | -4.24% |

| 1-year | -13.30% |

| 3-year | 9.91% |

| 5-year | 4.24% |

| YTD | -9.02% |

| 2023 | -5.97% |

| 2022 | -2.07% |

| 2021 | 21.45% |

| 2020 | -7.47% |

| 2019 | 17.70% |

IDA Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching IDA

Want to do more research on Idacorp Inc's stock and its price? Try the links below:Idacorp Inc (IDA) Stock Price | Nasdaq

Idacorp Inc (IDA) Stock Quote, History and News - Yahoo Finance

Idacorp Inc (IDA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...