CMS Energy Corp. (CMS): Price and Financial Metrics

CMS Price/Volume Stats

| Current price | $57.27 | 52-week high | $63.76 |

| Prev. close | $57.22 | 52-week low | $49.87 |

| Day low | $56.73 | Volume | 2,081,400 |

| Day high | $57.50 | Avg. volume | 2,236,088 |

| 50-day MA | $57.61 | Dividend yield | 3.4% |

| 200-day MA | $57.54 | Market Cap | 16.86B |

CMS Stock Price Chart Interactive Chart >

CMS POWR Grades

- CMS scores best on the Stability dimension, with a Stability rank ahead of 47.74% of US stocks.

- CMS's strongest trending metric is Stability; it's been moving down over the last 26 weeks.

- CMS's current lowest rank is in the Sentiment metric (where it is better than 5.82% of US stocks).

CMS Stock Summary

- Of note is the ratio of CMS ENERGY CORP's sales and general administrative expense to its total operating expenses; only 0.17% of US stocks have a lower such ratio.

- The ratio of debt to operating expenses for CMS ENERGY CORP is higher than it is for about 94.54% of US stocks.

- In terms of volatility of its share price, CMS is more volatile than merely 4.82% of stocks we're observing.

- Stocks that are quantitatively similar to CMS, based on their financial statements, market capitalization, and price volatility, are CNP, ETR, ES, AEE, and LNT.

- Visit CMS's SEC page to see the company's official filings. To visit the company's web site, go to www.cmsenergy.com.

CMS Valuation Summary

- In comparison to the median Utilities stock, CMS's price/sales ratio is 22.22% higher, now standing at 2.2.

- CMS's price/sales ratio has moved up 2 over the prior 243 months.

Below are key valuation metrics over time for CMS.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| CMS | 2023-12-27 | 2.2 | 2.3 | 22.7 | 16.9 |

| CMS | 2023-12-26 | 2.2 | 2.3 | 22.7 | 16.9 |

| CMS | 2023-12-22 | 2.1 | 2.3 | 22.6 | 16.8 |

| CMS | 2023-12-21 | 2.1 | 2.3 | 22.5 | 16.8 |

| CMS | 2023-12-20 | 2.1 | 2.3 | 22.5 | 16.8 |

| CMS | 2023-12-19 | 2.2 | 2.4 | 22.9 | 17.0 |

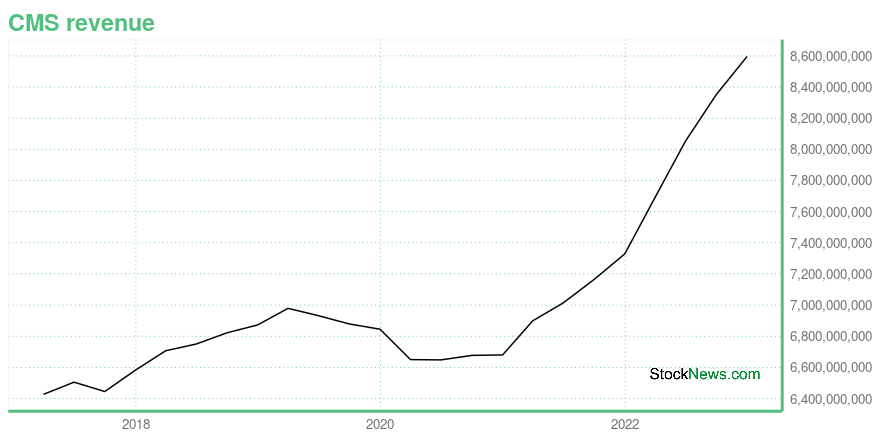

CMS Growth Metrics

- Its 3 year net cashflow from operations growth rate is now at 5.09%.

- Its 2 year price growth rate is now at 16.36%.

- The 2 year net cashflow from operations growth rate now stands at 23.29%.

The table below shows CMS's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 8,596 | 855 | 827 |

| 2022-09-30 | 8,351 | 1,003 | 1,296 |

| 2022-06-30 | 8,052 | 1,511 | 1,319 |

| 2022-03-31 | 7,690 | 1,694 | 1,350 |

| 2021-12-31 | 7,329 | 1,819 | 1,348 |

| 2021-09-30 | 7,164 | 1,615 | 869 |

CMS's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- CMS has a Quality Grade of C, ranking ahead of 31.74% of graded US stocks.

- CMS's asset turnover comes in at 0.239 -- ranking 39th of 105 Utilities stocks.

- DUK, AEP, and NI are the stocks whose asset turnover ratios are most correlated with CMS.

The table below shows CMS's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.239 | 0.398 | 0.047 |

| 2021-06-30 | 0.237 | 0.418 | 0.049 |

| 2021-03-31 | 0.235 | 0.423 | 0.048 |

| 2020-12-31 | 0.232 | 0.415 | 0.045 |

| 2020-09-30 | 0.238 | 0.405 | 0.047 |

| 2020-06-30 | 0.244 | 0.401 | 0.047 |

CMS Price Target

For more insight on analysts targets of CMS, see our CMS price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $67.57 | Average Broker Recommendation | 1.69 (Moderate Buy) |

CMS Energy Corp. (CMS) Company Bio

CMS Energy (NYSE: CMS), based in Jackson, Michigan, is an energy company that is focused principally on utility operations in Michigan. Its principal business is Consumers Energy, a public utility that provides electricity and natural gas to more than 6 million of Michigan's 10 million residents. Its non-utility businesses are focused primarily on domestic independent power production. Consumers Energy has operated since 1886. (Source:Wikipedia)

Latest CMS News From Around the Web

Below are the latest news stories about CMS ENERGY CORP that investors may wish to consider to help them evaluate CMS as an investment opportunity.

Consumers Energy Continues Billion-Dollar Natural Gas Investment to Reduce Long-Term Costs for CustomersConsumers Energy is continuing its $1 billion annual investment in the company's natural gas delivery system as part of its Natural Gas Delivery Plan, resulting in miles of aging and outdated pipeline replaced every year and reducing long-term costs for customers by providing cleaner, more reliable natural gas for decades to come. |

CMS Energy's (NYSE:CMS) investors will be pleased with their respectable 31% return over the last five yearsWhen you buy and hold a stock for the long term, you definitely want it to provide a positive return. But more than... |

NiSource (NI) Down 0.5% Since Last Earnings Report: Can It Rebound?NiSource (NI) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

Why Is PSEG (PEG) Up 1.5% Since Last Earnings Report?PSEG (PEG) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

CMS Energy Declares Quarterly Dividend on Cumulative Redeemable Perpetual Preferred StockThe Board of Directors of CMS Energy has declared a dividend on the 4.200% Cumulative Redeemable Perpetual Preferred Stock, Series C of the Corporation. |

CMS Price Returns

| 1-mo | 1.47% |

| 3-mo | 0.77% |

| 6-mo | 1.59% |

| 1-year | -5.24% |

| 3-year | 11.13% |

| 5-year | 24.33% |

| YTD | -1.38% |

| 2023 | -5.21% |

| 2022 | 0.18% |

| 2021 | 9.71% |

| 2020 | -0.32% |

| 2019 | 30.03% |

CMS Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CMS

Want to see what other sources are saying about Cms Energy Corp's financials and stock price? Try the links below:Cms Energy Corp (CMS) Stock Price | Nasdaq

Cms Energy Corp (CMS) Stock Quote, History and News - Yahoo Finance

Cms Energy Corp (CMS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...