NRG Energy Inc. (NRG): Price and Financial Metrics

NRG Price/Volume Stats

| Current price | $51.90 | 52-week high | $55.36 |

| Prev. close | $52.02 | 52-week low | $30.25 |

| Day low | $51.80 | Volume | 1,862,200 |

| Day high | $52.68 | Avg. volume | 3,012,585 |

| 50-day MA | $51.35 | Dividend yield | 3.14% |

| 200-day MA | $41.72 | Market Cap | 11.72B |

NRG Stock Price Chart Interactive Chart >

NRG POWR Grades

- Growth is the dimension where NRG ranks best; there it ranks ahead of 83.54% of US stocks.

- The strongest trend for NRG is in Growth, which has been heading up over the past 26 weeks.

- NRG's current lowest rank is in the Sentiment metric (where it is better than 10.91% of US stocks).

NRG Stock Summary

- The capital turnover (annual revenue relative to shareholder's equity) for NRG is 8.49 -- better than 95.51% of US stocks.

- NRG's price/sales ratio is 0.39; that's higher than the P/S ratio of merely 12.68% of US stocks.

- Over the past twelve months, NRG has reported earnings growth of -158.32%, putting it ahead of merely 8.61% of US stocks in our set.

- Stocks with similar financial metrics, market capitalization, and price volatility to NRG ENERGY INC are BERY, GLT, BALY, WWW, and FLL.

- NRG's SEC filings can be seen here. And to visit NRG ENERGY INC's official web site, go to www.nrg.com.

NRG Valuation Summary

- In comparison to the median Utilities stock, NRG's price/sales ratio is 77.78% lower, now standing at 0.4.

- NRG's EV/EBIT ratio has moved NA NA over the prior 240 months.

Below are key valuation metrics over time for NRG.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| NRG | 2023-12-27 | 0.4 | 3.3 | -6.4 | -16.5 |

| NRG | 2023-12-26 | 0.4 | 3.3 | -6.3 | -16.4 |

| NRG | 2023-12-22 | 0.4 | 3.2 | -6.2 | -16.3 |

| NRG | 2023-12-21 | 0.4 | 3.2 | -6.2 | -16.3 |

| NRG | 2023-12-20 | 0.4 | 3.2 | -6.1 | -16.2 |

| NRG | 2023-12-19 | 0.4 | 3.2 | -6.2 | -16.3 |

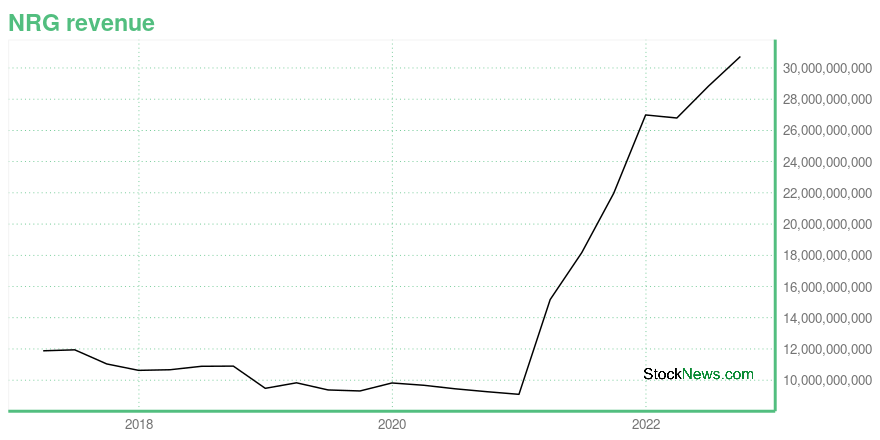

NRG Growth Metrics

- Its 2 year price growth rate is now at 28.89%.

- The 4 year revenue growth rate now stands at -18.57%.

- Its 4 year net cashflow from operations growth rate is now at 20.55%.

The table below shows NRG's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 30,734 | 396 | 1,889 |

| 2022-06-30 | 28,833 | 3,305 | 3,440 |

| 2022-03-31 | 26,794 | 3,086 | 4,005 |

| 2021-12-31 | 26,989 | 493 | 2,187 |

| 2021-09-30 | 21,970 | 2,306 | 2,441 |

| 2021-06-30 | 18,170 | 1,522 | 1,072 |

NRG's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- NRG has a Quality Grade of C, ranking ahead of 32.91% of graded US stocks.

- NRG's asset turnover comes in at 1.069 -- ranking 3rd of 105 Utilities stocks.

- VST, NEP, and PCG are the stocks whose asset turnover ratios are most correlated with NRG.

The table below shows NRG's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 1.069 | 0.259 | 0.103 |

| 2021-03-31 | 1.033 | 0.212 | 0.051 |

| 2020-12-31 | 0.696 | 0.281 | 0.072 |

| 2020-09-30 | 0.742 | 0.290 | 0.084 |

| 2020-06-30 | 0.800 | 0.291 | 0.090 |

| 2020-03-31 | 0.879 | 0.265 | 0.080 |

NRG Price Target

For more insight on analysts targets of NRG, see our NRG price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $47.30 | Average Broker Recommendation | 1.59 (Moderate Buy) |

NRG Energy Inc. (NRG) Company Bio

NRG Energy, Inc. is an American energy company, headquartered in Houston, Texas. It was formerly the wholesale arm of Northern States Power Company (NSP), which became Xcel Energy, but became independent in 2000. NRG Energy is involved in energy generation and retail electricity. Their portfolio includes natural gas generation, coal generation, oil generation, nuclear generation, wind generation, utility scale generation, and distributed solar generation. NRG serves 6 million retail customers in 24 US states including Texas, Connecticut, Delaware, Illinois, Maryland, Massachusetts, New Jersey, New York, Pennsylvania, Ohio; the District of Columbia, and eight provinces in Canada. (Source:Wikipedia)

Latest NRG News From Around the Web

Below are the latest news stories about NRG ENERGY INC that investors may wish to consider to help them evaluate NRG as an investment opportunity.

4 GARP Stocks to Scoop Up for Maximum ReturnsTry the GARP strategy when seeking a profitable portfolio of stocks offering optimum value and growth investing. ARCO, NVDA, NRG and CSL are some stocks that hold promise. |

Investing in NRG Energy (NYSE:NRG) a year ago would have delivered you a 62% gainThese days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But investors can... |

The Zacks Analyst Blog Highlights 3M, Omnicom, Amcor, NiSource and NRG Energy3M, Omnicom, Amcor, NiSource and NRG Energy are included in this Analyst Blog. |

5 Amazing Dividend Stocks to Buy for Secure Income in 2024Investors leveraging dividend-paying stocks to build a portfolio that emphasizes quality and sustainability can effectively weather market risks. Stocks like MMM, OMC, AMCR, NI and NRG are must-haves for your portfolio. |

Zacks.com featured highlights include NRG Energy, Thomson Reuters, Suzano, Cboe Global Markets and Arch Capital GroupNRG Energy, Thomson Reuters, Suzano, Cboe Global Markets and Arch Capital Group are part of the Zacks Screen of the Week article. |

NRG Price Returns

| 1-mo | -0.43% |

| 3-mo | 15.69% |

| 6-mo | 41.61% |

| 1-year | 57.49% |

| 3-year | 46.27% |

| 5-year | 44.06% |

| YTD | 1.15% |

| 2023 | 69.35% |

| 2022 | -23.47% |

| 2021 | 18.54% |

| 2020 | -2.14% |

| 2019 | 0.69% |

NRG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NRG

Want to do more research on Nrg Energy Inc's stock and its price? Try the links below:Nrg Energy Inc (NRG) Stock Price | Nasdaq

Nrg Energy Inc (NRG) Stock Quote, History and News - Yahoo Finance

Nrg Energy Inc (NRG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...