Hovnanian Enterprises, Inc. (HOV): Price and Financial Metrics

HOV Price/Volume Stats

| Current price | $160.60 | 52-week high | $183.60 |

| Prev. close | $168.10 | 52-week low | $60.06 |

| Day low | $160.10 | Volume | 94,000 |

| Day high | $165.95 | Avg. volume | 82,806 |

| 50-day MA | $155.47 | Dividend yield | N/A |

| 200-day MA | $109.45 | Market Cap | 978.86M |

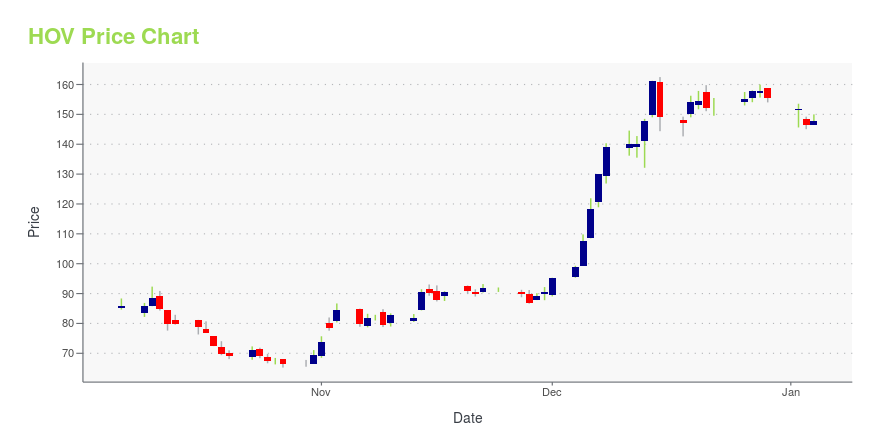

HOV Stock Price Chart Interactive Chart >

HOV POWR Grades

- Momentum is the dimension where HOV ranks best; there it ranks ahead of 99.98% of US stocks.

- HOV's strongest trending metric is Stability; it's been moving down over the last 26 weeks.

- HOV ranks lowest in Stability; there it ranks in the 12th percentile.

HOV Stock Summary

- With a price/earnings ratio of 4.57, HOVNANIAN ENTERPRISES INC P/E ratio is greater than that of about only 4.43% of stocks in our set with positive earnings.

- The price/operating cash flow metric for HOVNANIAN ENTERPRISES INC is higher than only 5.95% of stocks in our set with a positive cash flow.

- Of note is the ratio of HOVNANIAN ENTERPRISES INC's sales and general administrative expense to its total operating expenses; 98.81% of US stocks have a lower such ratio.

- If you're looking for stocks that are quantitatively similar to HOVNANIAN ENTERPRISES INC, a group of peers worth examining would be HEES, GBX, DXPE, SON, and DFH.

- Visit HOV's SEC page to see the company's official filings. To visit the company's web site, go to www.khov.com.

HOV Valuation Summary

- In comparison to the median Consumer Cyclical stock, HOV's EV/EBIT ratio is 62.75% lower, now standing at 5.7.

- Over the past 243 months, HOV's price/sales ratio has gone down 0.5.

Below are key valuation metrics over time for HOV.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| HOV | 2023-12-29 | 0.3 | 1.6 | 4.9 | 5.7 |

| HOV | 2023-12-28 | 0.3 | 1.7 | 4.9 | 5.8 |

| HOV | 2023-12-27 | 0.3 | 1.7 | 4.9 | 5.8 |

| HOV | 2023-12-26 | 0.3 | 1.6 | 4.8 | 5.7 |

| HOV | 2023-12-22 | 0.3 | 1.6 | 4.8 | 5.7 |

| HOV | 2023-12-21 | 0.3 | 1.6 | 4.7 | 5.6 |

HOV Growth Metrics

- Its 2 year price growth rate is now at 130.41%.

- The 4 year price growth rate now stands at -54.72%.

- Its year over year net income to common stockholders growth rate is now at -67.69%.

The table below shows HOV's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 2,922.231 | 89.466 | 214.815 |

| 2022-06-30 | 2,849.791 | 99.344 | 214.33 |

| 2022-03-31 | 2,772.881 | 132.55 | 182.087 |

| 2021-12-31 | 2,773.506 | 188.543 | 610.997 |

| 2021-09-30 | 2,782.857 | 210.213 | 607.817 |

| 2021-06-30 | 2,651.867 | 182.266 | 595.971 |

HOV's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- HOV has a Quality Grade of C, ranking ahead of 60.31% of graded US stocks.

- HOV's asset turnover comes in at 1.274 -- ranking 25th of 51 Construction stocks.

- ESOA, MTRX, and EME are the stocks whose asset turnover ratios are most correlated with HOV.

The table below shows HOV's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-07-31 | 1.274 | 0.207 | 0.070 |

| 2021-04-30 | 1.324 | 0.195 | 0.061 |

| 2021-01-31 | 1.312 | 0.186 | 0.055 |

| 2020-10-31 | 1.279 | 0.176 | 0.046 |

| 2020-07-31 | 1.286 | 0.165 | 0.033 |

| 2020-04-30 | 1.209 | 0.165 | 0.024 |

Hovnanian Enterprises, Inc. (HOV) Company Bio

Hovnanian Enterprises designs, constructs, markets, and sells residential homes in the United States. The company was founded in 1959 and is based in Red Bank, New Jersey.

Latest HOV News From Around the Web

Below are the latest news stories about HOVNANIAN ENTERPRISES INC that investors may wish to consider to help them evaluate HOV as an investment opportunity.

Director Vincent Pagano Sells Shares of Hovnanian Enterprises IncVincent Pagano, a director at Hovnanian Enterprises Inc, executed a sale of 3,862 shares in the company on December 20, 2023, according to a recent SEC Filing. |

Insider Sell Alert: Director Edward Kangas Sells 5,000 Shares of Hovnanian Enterprises Inc (HOV)Director Edward Kangas has recently made a significant stock transaction in Hovnanian Enterprises Inc (NYSE:HOV), selling 5,000 shares on December 15, 2023. |

K. Hovnanian®️ Introduces Locke Landing, a New LOOKS Community in Baltimore, MDBALTIMORE, Dec. 14, 2023 (GLOBE NEWSWIRE) -- K. Hovnanian Homes introduces Locke Landing, a new community of townhomes within the mixed-use development Baltimore Peninsula. Locke Landing is K. Hovnanian’s first Baltimore community to offer LOOKS: designer-curated collections of beautiful interiors. Buyers can choose from 4 unique interiors—Loft, Farmhouse, Classic or Elements—and enjoy cohesive style without the stress. "By whittling down an overwhelming number of design choices, we’ve been able |

K. Hovnanian® Introduces The Grove at Jackson Village, a New LOOKS Community in Fredericksburg, VAFREDERICKSBURG, Va., Dec. 13, 2023 (GLOBE NEWSWIRE) -- K. Hovnanian️ Homes introduces The Grove at Jackson Village, an 850-unit townhome community in Fredericksburg. This community offers LOOKS: a designer-curated collection of beautiful interiors. Buyers can choose between Loft, Farmhouse, Classic or Elements LOOKS, and enjoy cohesive style without the stress. "By whittling down an overwhelming number of design choices, we’ve been able to focus on making our 'LOOKS' stand out," said Alexander H |

These Two Players In Home Construction Are Reaching New HighsThis homebuilder stock hit a 52-week high on Friday and topped a buy zone. An air conditioning and heating stock also hit a buy point on Friday. |

HOV Price Returns

| 1-mo | 6.38% |

| 3-mo | 78.92% |

| 6-mo | 67.36% |

| 1-year | 153.91% |

| 3-year | 174.67% |

| 5-year | 844.71% |

| YTD | 3.20% |

| 2023 | 269.82% |

| 2022 | -66.94% |

| 2021 | 287.37% |

| 2020 | 57.45% |

| 2019 | 22.76% |

Continue Researching HOV

Want to do more research on Hovnanian Enterprises Inc's stock and its price? Try the links below:Hovnanian Enterprises Inc (HOV) Stock Price | Nasdaq

Hovnanian Enterprises Inc (HOV) Stock Quote, History and News - Yahoo Finance

Hovnanian Enterprises Inc (HOV) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...