Magnolia Oil & Gas Corporation (MGY): Price and Financial Metrics

MGY Price/Volume Stats

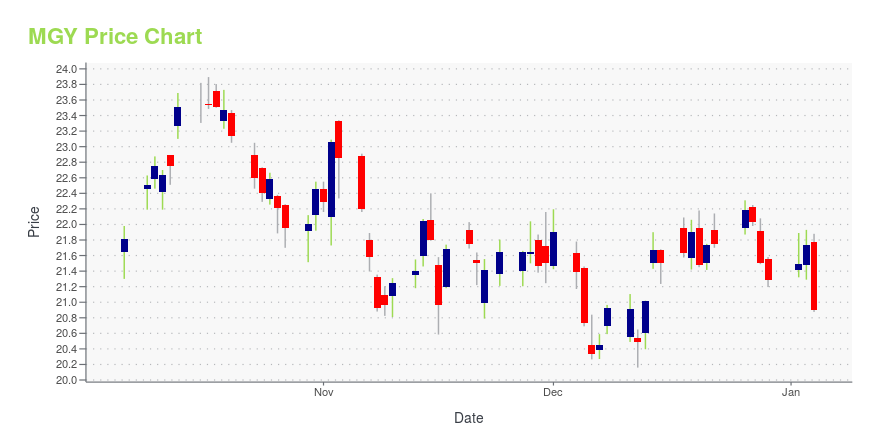

| Current price | $21.42 | 52-week high | $24.02 |

| Prev. close | $21.37 | 52-week low | $18.72 |

| Day low | $21.16 | Volume | 3,147,600 |

| Day high | $21.60 | Avg. volume | 2,544,451 |

| 50-day MA | $20.79 | Dividend yield | 2.43% |

| 200-day MA | $21.42 | Market Cap | 4.44B |

MGY Stock Price Chart Interactive Chart >

MGY POWR Grades

- MGY scores best on the Quality dimension, with a Quality rank ahead of 95.28% of US stocks.

- MGY's strongest trending metric is Momentum; it's been moving down over the last 26 weeks.

- MGY's current lowest rank is in the Sentiment metric (where it is better than 0.7% of US stocks).

MGY Stock Summary

- Of note is the ratio of MAGNOLIA OIL & GAS CORP's sales and general administrative expense to its total operating expenses; only 5.59% of US stocks have a lower such ratio.

- Revenue growth over the past 12 months for MAGNOLIA OIL & GAS CORP comes in at -25.47%, a number that bests merely 10.77% of the US stocks we're tracking.

- In terms of volatility of its share price, MGY is more volatile than merely 8.19% of stocks we're observing.

- Stocks with similar financial metrics, market capitalization, and price volatility to MAGNOLIA OIL & GAS CORP are TLRY, PTEN, GTE, CTRA, and ARLP.

- Visit MGY's SEC page to see the company's official filings. To visit the company's web site, go to www.magnoliaoilgas.com.

MGY Valuation Summary

- MGY's EV/EBIT ratio is 7.8; this is 6.02% lower than that of the median Energy stock.

- Over the past 79 months, MGY's price/sales ratio has gone NA NA.

Below are key valuation metrics over time for MGY.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| MGY | 2023-12-28 | 3.6 | 2.7 | 8.5 | 7.8 |

| MGY | 2023-12-27 | 3.6 | 2.7 | 8.7 | 8.0 |

| MGY | 2023-12-26 | 3.7 | 2.8 | 8.8 | 8.1 |

| MGY | 2023-12-22 | 3.6 | 2.7 | 8.6 | 7.9 |

| MGY | 2023-12-21 | 3.6 | 2.7 | 8.6 | 7.9 |

| MGY | 2023-12-20 | 3.5 | 2.7 | 8.5 | 7.8 |

MGY's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- MGY has a Quality Grade of A, ranking ahead of 96.31% of graded US stocks.

- MGY's asset turnover comes in at 0.595 -- ranking 38th of 136 Petroleum and Natural Gas stocks.

- 500 - Internal server error

The table below shows MGY's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.595 | 0.867 | 0.217 |

| 2021-06-30 | 0.499 | 0.849 | 0.142 |

| 2021-03-31 | 0.390 | 0.815 | 0.070 |

| 2020-12-31 | 0.369 | 0.798 | -0.819 |

| 2020-09-30 | 0.315 | 0.815 | -0.630 |

| 2020-06-30 | 0.298 | 0.834 | -0.503 |

MGY Price Target

For more insight on analysts targets of MGY, see our MGY price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $17.38 | Average Broker Recommendation | 1.6 (Moderate Buy) |

Magnolia Oil & Gas Corporation (MGY) Company Bio

Magnolia Oil & Gas Corporation operates as an oil and gas exploration and production company. It has operations in South Texas in the core of the Eagle Ford. The company is based in Houston, Texas.

Latest MGY News From Around the Web

Below are the latest news stories about MAGNOLIA OIL & GAS CORP that investors may wish to consider to help them evaluate MGY as an investment opportunity.

Why Is Magnolia Oil & Gas Corp (MGY) Down 6.8% Since Last Earnings Report?Magnolia Oil & Gas Corp (MGY) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

Magnolia Oil & Gas Corporation's (NYSE:MGY) Stock Has Been Sliding But Fundamentals Look Strong: Is The Market Wrong?It is hard to get excited after looking at Magnolia Oil & Gas' (NYSE:MGY) recent performance, when its stock has... |

Magnolia (MGY) Q3 Earnings Beat Estimates, Revenues In LineMagnolia (MGY) expects total D&C capital expenditures for 2023 to be $430 million, with a diluted share count of 207 million in the fourth quarter. |

Magnolia Oil & Gas Corporation (NYSE:MGY) Q3 2023 Earnings Call TranscriptMagnolia Oil & Gas Corporation (NYSE:MGY) Q3 2023 Earnings Call Transcript November 2, 2023 Operator: Good morning, everyone, and thank you for participating in Magnolia Oil & Gas Corporation’s Third Quarter 2023 Earnings Conference Call. My name is Marliese, and I will be your moderator for today’s call. At this time, all participants will be […] |

Magnolia Oil & Gas Corporation (NYSE:MGY) Looks Interesting, And It's About To Pay A DividendRegular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Magnolia Oil... |

MGY Price Returns

| 1-mo | 9.93% |

| 3-mo | 0.22% |

| 6-mo | -2.51% |

| 1-year | 3.21% |

| 3-year | 123.00% |

| 5-year | 77.94% |

| YTD | 1.26% |

| 2023 | -7.26% |

| 2022 | 26.52% |

| 2021 | 168.77% |

| 2020 | -43.88% |

| 2019 | 12.22% |

MGY Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...