InterDigital Inc. (IDCC): Price and Financial Metrics

IDCC Price/Volume Stats

| Current price | $117.19 | 52-week high | $119.86 |

| Prev. close | $116.15 | 52-week low | $66.82 |

| Day low | $113.38 | Volume | 1,300,200 |

| Day high | $119.86 | Avg. volume | 408,976 |

| 50-day MA | $106.41 | Dividend yield | 1.37% |

| 200-day MA | $91.56 | Market Cap | 3.01B |

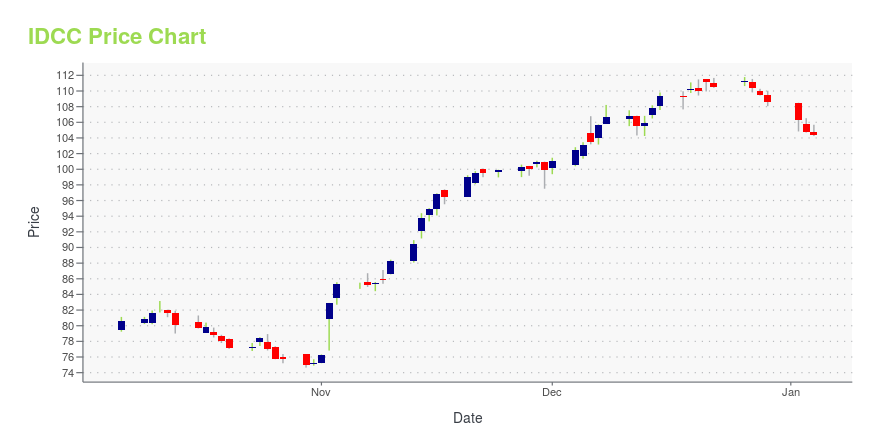

IDCC Stock Price Chart Interactive Chart >

IDCC POWR Grades

- Quality is the dimension where IDCC ranks best; there it ranks ahead of 92.99% of US stocks.

- The strongest trend for IDCC is in Quality, which has been heading up over the past 26 weeks.

- IDCC's current lowest rank is in the Stability metric (where it is better than 22.67% of US stocks).

IDCC Stock Summary

- Of note is the ratio of INTERDIGITAL INC's sales and general administrative expense to its total operating expenses; 87.34% of US stocks have a lower such ratio.

- For IDCC, its debt to operating expenses ratio is greater than that reported by 93.69% of US equities we're observing.

- Over the past twelve months, IDCC has reported earnings growth of 116.41%, putting it ahead of 90.86% of US stocks in our set.

- Stocks that are quantitatively similar to IDCC, based on their financial statements, market capitalization, and price volatility, are UAN, NOA, JEWL, EXP, and PGNY.

- IDCC's SEC filings can be seen here. And to visit INTERDIGITAL INC's official web site, go to www.interdigital.com.

IDCC Valuation Summary

- In comparison to the median Communication Services stock, IDCC's price/sales ratio is 257.14% higher, now standing at 5.

- IDCC's EV/EBIT ratio has moved down 14.6 over the prior 243 months.

Below are key valuation metrics over time for IDCC.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| IDCC | 2023-12-29 | 5.0 | 4.8 | 13.5 | 9.9 |

| IDCC | 2023-12-28 | 5.0 | 4.8 | 13.6 | 9.9 |

| IDCC | 2023-12-27 | 5.1 | 4.9 | 13.7 | 10.0 |

| IDCC | 2023-12-26 | 5.1 | 4.9 | 13.8 | 10.1 |

| IDCC | 2023-12-22 | 5.1 | 4.9 | 13.7 | 10.0 |

| IDCC | 2023-12-21 | 5.1 | 4.9 | 13.8 | 10.1 |

IDCC Growth Metrics

- The 2 year revenue growth rate now stands at 36.1%.

- Its 2 year net cashflow from operations growth rate is now at 31%.

- Its 3 year price growth rate is now at -13.41%.

The table below shows IDCC's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 457.794 | 286.039 | 93.693 |

| 2022-09-30 | 452.554 | 0.76 | 83.163 |

| 2022-06-30 | 481.286 | 115.753 | 87.169 |

| 2022-03-31 | 444.364 | 122.262 | 67.718 |

| 2021-12-31 | 425.409 | 130.392 | 55.295 |

| 2021-09-30 | 404.384 | 78.418 | 32.067 |

IDCC's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- IDCC has a Quality Grade of C, ranking ahead of 65.38% of graded US stocks.

- IDCC's asset turnover comes in at 0.221 -- ranking 88th of 444 Trading stocks.

- RAND, BGCP, and TRTX are the stocks whose asset turnover ratios are most correlated with IDCC.

The table below shows IDCC's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.221 | 0.515 | 0.066 |

| 2021-03-31 | 0.230 | 0.544 | 0.115 |

| 2020-12-31 | 0.229 | 0.526 | 0.123 |

| 2020-09-30 | 0.237 | 0.552 | 0.177 |

| 2020-06-30 | 0.228 | 0.549 | 0.160 |

| 2020-03-31 | 0.209 | 0.513 | 0.125 |

IDCC Price Target

For more insight on analysts targets of IDCC, see our IDCC price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $97.00 | Average Broker Recommendation | 1.12 (Strong Buy) |

InterDigital Inc. (IDCC) Company Bio

InterDigital, Inc. engages in the design and development of technologies that enable and enhance wireless communications, and capabilities. It focuses on mobile technology and devices, which includes cellular wireless technology, Internet of Things, technology, video coding & transmission, sensor and sensor fusion technology. It also offers digital cellular and wireless products and networks, including 2G, 3G, 4G and IEEE 802-related products and networks. The company was founded by Seligsohn I. Sherwin in 1972 and is headquartered in Wilmington, DE.

Latest IDCC News From Around the Web

Below are the latest news stories about INTERDIGITAL INC that investors may wish to consider to help them evaluate IDCC as an investment opportunity.

The Next Big Thing: 3 Tech Stocks Ready for a 500% Leap by 2027Are you looking for the next big thing in the stock-market? |

3 Telecom Stocks You Should Not Miss Adding to 2024 PortfolioU.S. Cellular (USM), Arista (ANET) and InterDigital (IDCC) are poised to benefit in 2024 owing to healthy growth dynamics and solid fundamentals. |

Jim Cramer Stock Portfolio: 12 Recent AdditionsIn this article, we discuss the 12 recent additions to the Jim Cramer stock portfolio. If you want to read about some more Cramer stocks, go directly to Jim Cramer Stock Portfolio: 5 Recent Additions. Jim Cramer, the host of Mad Money on CNBC, is one of the most well-known finance personalities on television. He […] |

InterDigital (IDCC) Is Up 2.49% in One Week: What You Should KnowDoes InterDigital (IDCC) have what it takes to be a top stock pick for momentum investors? Let's find out. |

Should You Be Adding InterDigital (NASDAQ:IDCC) To Your Watchlist Today?The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even... |

IDCC Price Returns

| 1-mo | 10.12% |

| 3-mo | 18.23% |

| 6-mo | 39.47% |

| 1-year | 60.47% |

| 3-year | 94.42% |

| 5-year | 80.12% |

| YTD | 8.38% |

| 2023 | 123.67% |

| 2022 | -29.25% |

| 2021 | 20.49% |

| 2020 | 14.28% |

| 2019 | -16.11% |

IDCC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching IDCC

Here are a few links from around the web to help you further your research on InterDigital Inc's stock as an investment opportunity:InterDigital Inc (IDCC) Stock Price | Nasdaq

InterDigital Inc (IDCC) Stock Quote, History and News - Yahoo Finance

InterDigital Inc (IDCC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...