Coca-Cola Consolidated, Inc. (COKE): Price and Financial Metrics

COKE Price/Volume Stats

| Current price | $846.07 | 52-week high | $961.91 |

| Prev. close | $864.59 | 52-week low | $495.11 |

| Day low | $845.71 | Volume | 59,500 |

| Day high | $859.72 | Avg. volume | 45,664 |

| 50-day MA | $878.53 | Dividend yield | 0.24% |

| 200-day MA | $717.02 | Market Cap | 7.93B |

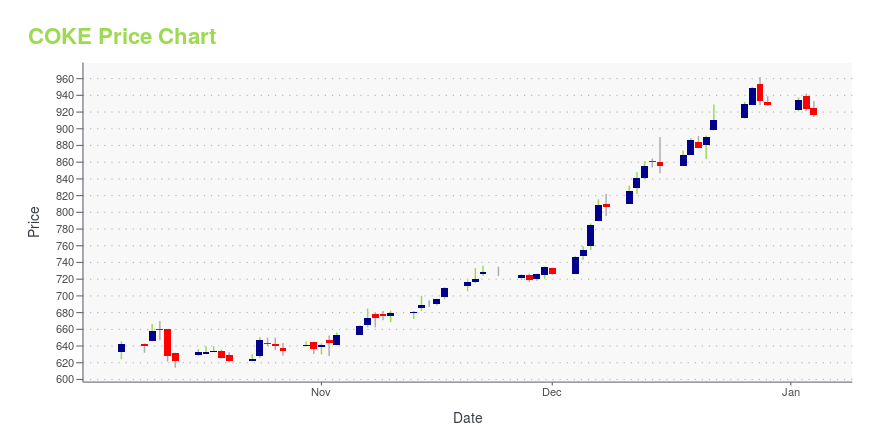

COKE Stock Price Chart Interactive Chart >

COKE POWR Grades

- COKE scores best on the Quality dimension, with a Quality rank ahead of 96.53% of US stocks.

- The strongest trend for COKE is in Growth, which has been heading down over the past 26 weeks.

- COKE ranks lowest in Momentum; there it ranks in the 13th percentile.

COKE Stock Summary

- COKE has a market capitalization of $8,661,288,636 -- more than approximately 81.38% of US stocks.

- The capital turnover (annual revenue relative to shareholder's equity) for COKE is 4.33 -- better than 88.58% of US stocks.

- COCA-COLA CONSOLIDATED INC's stock had its IPO on March 26, 1990, making it an older stock than 84.83% of US equities in our set.

- Stocks with similar financial metrics, market capitalization, and price volatility to COCA-COLA CONSOLIDATED INC are IBP, WCC, CACI, ZEUS, and RUSHA.

- Visit COKE's SEC page to see the company's official filings. To visit the company's web site, go to www.cokeconsolidated.com.

COKE Valuation Summary

- In comparison to the median Consumer Defensive stock, COKE's EV/EBIT ratio is 18.05% lower, now standing at 14.3.

- COKE's price/sales ratio has moved up 0.9 over the prior 243 months.

Below are key valuation metrics over time for COKE.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| COKE | 2023-12-22 | 1.3 | 5.6 | 18.9 | 14.3 |

| COKE | 2023-12-21 | 1.3 | 5.5 | 18.5 | 13.9 |

| COKE | 2023-12-20 | 1.2 | 5.4 | 18.2 | 13.7 |

| COKE | 2023-12-19 | 1.3 | 5.5 | 18.4 | 13.9 |

| COKE | 2023-12-18 | 1.2 | 5.3 | 18.1 | 13.6 |

| COKE | 2023-12-15 | 1.2 | 5.3 | 17.8 | 13.4 |

COKE Growth Metrics

- Its 3 year price growth rate is now at 25.34%.

- Its 2 year net income to common stockholders growth rate is now at 598.57%.

- Its 5 year price growth rate is now at 14.71%.

The table below shows COKE's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 6,200.957 | 554.506 | 430.158 |

| 2022-09-30 | 6,030.501 | 476.189 | 330.82 |

| 2022-06-30 | 5,859.344 | 493.905 | 280.989 |

| 2022-03-31 | 5,697.215 | 570.726 | 229.607 |

| 2021-12-31 | 5,562.714 | 521.755 | 189.58 |

| 2021-09-30 | 5,439.012 | 557.935 | 236.851 |

COKE's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- COKE has a Quality Grade of B, ranking ahead of 91.6% of graded US stocks.

- COKE's asset turnover comes in at 1.621 -- ranking 3rd of 6 Candy & Soda stocks.

- FIZZ, PRMW, and MNST are the stocks whose asset turnover ratios are most correlated with COKE.

The table below shows COKE's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-07-02 | 1.621 | 0.354 | 0.128 |

| 2021-04-02 | 1.570 | 0.355 | 0.123 |

| 2020-12-31 | 1.551 | 0.353 | 0.102 |

| 2020-09-27 | 1.531 | 0.351 | 0.068 |

| 2020-06-28 | 1.537 | 0.346 | 0.049 |

| 2020-03-29 | 1.558 | 0.344 | 0.037 |

COKE Price Target

For more insight on analysts targets of COKE, see our COKE price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $144.00 | Average Broker Recommendation | 2 (Hold) |

Coca-Cola Consolidated, Inc. (COKE) Company Bio

Coca-Cola Bottling Company produces, markets, and distributes nonalcoholic beverages, primarily products of The Coca-Cola Company in the United States. The company was founded in 1902 and is based in Charlotte, North Carolina.

Latest COKE News From Around the Web

Below are the latest news stories about COCA-COLA CONSOLIDATED INC that investors may wish to consider to help them evaluate COKE as an investment opportunity.

Institutional investors are Coca-Cola Consolidated, Inc.'s (NASDAQ:COKE) biggest bettors and were rewarded after last week's US$466m market cap gainKey Insights Given the large stake in the stock by institutions, Coca-Cola Consolidated's stock price might be... |

Coca-Cola Consolidated Announces Declaration of First Quarter 2024 Regular Quarterly Cash Dividend and Special Cash DividendBoard of Directors declares a regular quarterly cash dividend of $0.50 per shareBoard of Directors declares a special cash dividend of $16.00 per share, totaling $150 million CHARLOTTE, N.C., Dec. 05, 2023 (GLOBE NEWSWIRE) -- Coca-Cola Consolidated, Inc. (NASDAQ: COKE) today announced that its Board of Directors has declared a regular quarterly cash dividend of $0.50 per share and a special cash dividend of $16.00 per share. Both the regular quarterly cash dividend and the special cash dividend |

Coca-Cola Consolidated (NASDAQ:COKE) shareholders have earned a 29% CAGR over the last five yearsWhen you buy a stock there is always a possibility that it could drop 100%. But on the bright side, if you buy shares... |

Coca-Cola Consolidated Reports Third Quarter and First Nine Months 2023 ResultsThird quarter of 2023 net sales increased 5% versus the third quarter of 2022.Income from operations for the third quarter of 2023 was $216 million, up $26 million, or 14%, versus the third quarter of 2022.Income from operations for the first nine months of 2023 was $656 million, up $188 million, or 40%, versus the first nine months of 2022. Operating margin for the first nine months of 2023 was 13.1% as compared to 10.1% for the first nine months of 2022, an increase of 300 basis points. Key Re |

Coca-Cola Consolidated, Inc. To Release Third Quarter and First Nine Months 2023 ResultsCHARLOTTE, N.C., Oct. 18, 2023 (GLOBE NEWSWIRE) -- Coca-Cola Consolidated, Inc. (NASDAQ: COKE) will issue a news release after the market closes on November 1, 2023 to announce its operating results for the third quarter ended September 29, 2023 and the first nine months of fiscal 2023. CONTACTS: Josh Gelinas (Media)Scott Anthony (Investors)Vice President, Communications Executive Vice President & Chief Financial Officer(704) 807-3703 (704) [email protected]@ |

COKE Price Returns

| 1-mo | 0.43% |

| 3-mo | 19.77% |

| 6-mo | 24.00% |

| 1-year | 62.96% |

| 3-year | 229.97% |

| 5-year | 291.20% |

| YTD | -7.11% |

| 2023 | 82.92% |

| 2022 | -17.09% |

| 2021 | 133.24% |

| 2020 | -5.87% |

| 2019 | 60.74% |

COKE Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching COKE

Want to do more research on Coca-Cola Consolidated Inc's stock and its price? Try the links below:Coca-Cola Consolidated Inc (COKE) Stock Price | Nasdaq

Coca-Cola Consolidated Inc (COKE) Stock Quote, History and News - Yahoo Finance

Coca-Cola Consolidated Inc (COKE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...