Brinks Company (The) (BCO): Price and Financial Metrics

BCO Price/Volume Stats

| Current price | $80.96 | 52-week high | $90.13 |

| Prev. close | $82.72 | 52-week low | $59.46 |

| Day low | $80.85 | Volume | 176,100 |

| Day high | $82.62 | Avg. volume | 189,921 |

| 50-day MA | $83.57 | Dividend yield | 1.09% |

| 200-day MA | $74.39 | Market Cap | 3.65B |

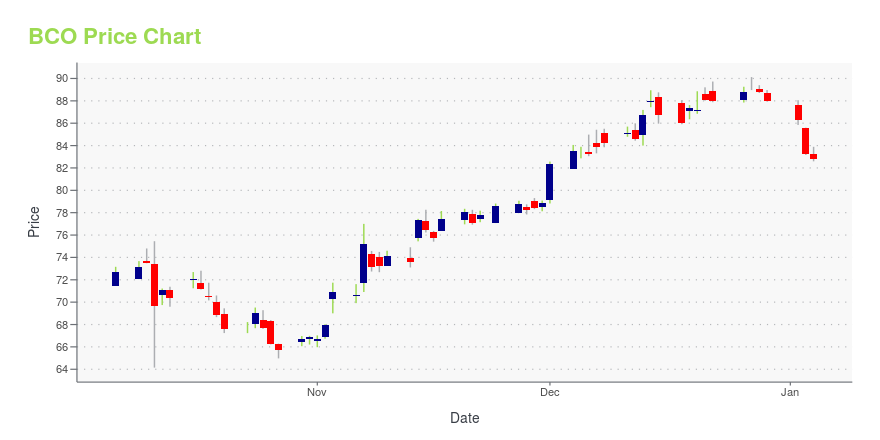

BCO Stock Price Chart Interactive Chart >

BCO POWR Grades

- BCO scores best on the Growth dimension, with a Growth rank ahead of 95.05% of US stocks.

- BCO's strongest trending metric is Quality; it's been moving up over the last 26 weeks.

- BCO ranks lowest in Momentum; there it ranks in the 42nd percentile.

BCO Stock Summary

- The capital turnover (annual revenue relative to shareholder's equity) for BCO is 10.41 -- better than 96.43% of US stocks.

- Of note is the ratio of BRINKS CO's sales and general administrative expense to its total operating expenses; 84.46% of US stocks have a lower such ratio.

- BCO's equity multiplier -- a measure of assets relative to shareholders'equity -- is greater than that of 94.84% of US stocks.

- If you're looking for stocks that are quantitatively similar to BRINKS CO, a group of peers worth examining would be CVU, WU, FTDR, ALTG, and BWMX.

- Visit BCO's SEC page to see the company's official filings. To visit the company's web site, go to www.brinks.com.

BCO Valuation Summary

- BCO's price/sales ratio is 0.8; this is 33.33% lower than that of the median Industrials stock.

- BCO's EV/EBIT ratio has moved down 6.3 over the prior 243 months.

Below are key valuation metrics over time for BCO.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| BCO | 2023-12-29 | 0.8 | 8.6 | 28.8 | 13.8 |

| BCO | 2023-12-28 | 0.8 | 8.6 | 29.0 | 13.9 |

| BCO | 2023-12-27 | 0.8 | 8.7 | 29.2 | 13.9 |

| BCO | 2023-12-26 | 0.8 | 8.6 | 29.0 | 13.9 |

| BCO | 2023-12-22 | 0.8 | 8.6 | 28.8 | 13.8 |

| BCO | 2023-12-21 | 0.8 | 8.6 | 28.8 | 13.8 |

BCO Growth Metrics

- The year over year net cashflow from operations growth rate now stands at 33.16%.

- The 5 year cash and equivalents growth rate now stands at 77.26%.

- Its 4 year net cashflow from operations growth rate is now at 80.88%.

The table below shows BCO's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 4,442.8 | 404.9 | 175.2 |

| 2022-06-30 | 4,381.6 | 438.1 | 175 |

| 2022-03-31 | 4,296.5 | 403.2 | 163.8 |

| 2021-12-31 | 4,200.2 | 478 | 105.2 |

| 2021-09-30 | 4,123.6 | 503.9 | 80.8 |

| 2021-06-30 | 4,018.6 | 458.7 | 37.9 |

BCO's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- BCO has a Quality Grade of C, ranking ahead of 64.4% of graded US stocks.

- BCO's asset turnover comes in at 0.769 -- ranking 36th of 137 Transportation stocks.

- DKL, YELL, and SKYW are the stocks whose asset turnover ratios are most correlated with BCO.

The table below shows BCO's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.769 | 0.231 | 0.072 |

| 2021-06-30 | 0.773 | 0.234 | 0.071 |

| 2021-03-31 | 0.759 | 0.225 | 0.052 |

| 2020-12-31 | 0.793 | 0.220 | 0.043 |

| 2020-09-30 | 0.836 | 0.216 | 0.029 |

| 2020-06-30 | 0.889 | 0.215 | 0.026 |

BCO Price Target

For more insight on analysts targets of BCO, see our BCO price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $96.67 | Average Broker Recommendation | 1.5 (Moderate Buy) |

Brinks Company (The) (BCO) Company Bio

Brink's Company is a leading provider of secure transportation and cash management services, as well as security-related services worldwide. The Brink's Company was founded in 1838 and is based in Richmond, Virginia.

Latest BCO News From Around the Web

Below are the latest news stories about BRINKS CO that investors may wish to consider to help them evaluate BCO as an investment opportunity.

The Brink's Company's (NYSE:BCO) Business Is Yet to Catch Up With Its Share PriceWhen close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 16x, you may... |

Is Brink's (BCO) Outperforming Other Business Services Stocks This Year?Here is how Brink's (BCO) and Broadridge Financial Solutions (BR) have performed compared to their sector so far this year. |

Record Q2 Revenue and Operating Profit Pushed Brink’s Company (BCO) in Q3Ariel Investments, an investment management company, released its “Ariel Small Cap Value Strategy” third-quarter 2023 investor letter. A copy of the same can be downloaded here. The Ariel Small Cap Value Tax-Exempt Composite declined -7.53% gross of fees (-7.76% net of fees) in the quarter underperforming both the Russell 2000 Value Index and the Russell 2000 […] |

Barrett Business Services, Inc. (BBSI) Hits Fresh High: Is There Still Room to Run?Barrett (BBSI) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues. |

Are Business Services Stocks Lagging Brink's (BCO) This Year?Here is how Brink's (BCO) and Broadridge Financial Solutions (BR) have performed compared to their sector so far this year. |

BCO Price Returns

| 1-mo | -0.86% |

| 3-mo | 5.27% |

| 6-mo | 10.62% |

| 1-year | 28.16% |

| 3-year | 15.46% |

| 5-year | 8.16% |

| YTD | -7.70% |

| 2023 | 65.85% |

| 2022 | -16.98% |

| 2021 | -8.00% |

| 2020 | -19.55% |

| 2019 | 41.29% |

BCO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BCO

Want to see what other sources are saying about Brinks Co's financials and stock price? Try the links below:Brinks Co (BCO) Stock Price | Nasdaq

Brinks Co (BCO) Stock Quote, History and News - Yahoo Finance

Brinks Co (BCO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...